Portman Ridge Finance Corp. (PTMN): Price and Financial Metrics

PTMN Price/Volume Stats

| Current price | $19.77 | 52-week high | $21.12 |

| Prev. close | $19.65 | 52-week low | $16.27 |

| Day low | $19.69 | Volume | 20,253 |

| Day high | $19.83 | Avg. volume | 38,622 |

| 50-day MA | $19.55 | Dividend yield | 13.98% |

| 200-day MA | $18.64 | Market Cap | 183.98M |

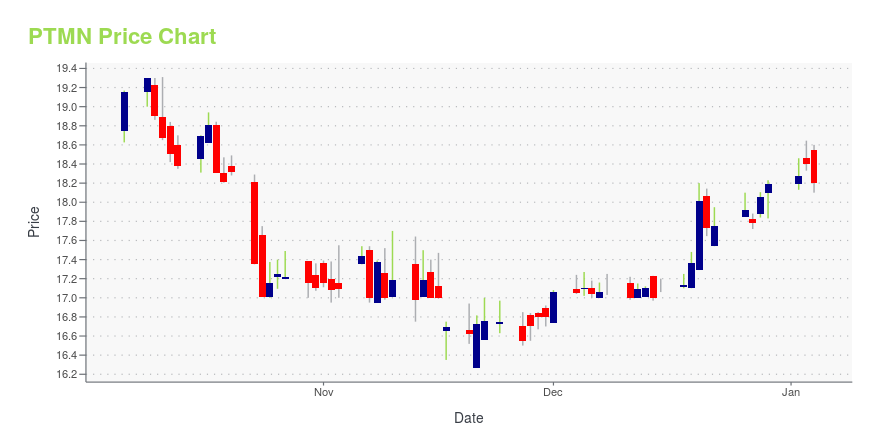

PTMN Stock Price Chart Interactive Chart >

Portman Ridge Finance Corp. (PTMN) Company Bio

Portman Ridge Finance Corp. operates as a non-diversified management investment company. The firm targets companies operating in the fields of aerospace/ defense, business services, consumer products, education, food & beverage, healthcare, industrial & environmental services, logistic & distribution and media & telecommunications. It provides financing in the form of debt and also makes equity co-investments. The company was founded on August 8, 2006 and is headquartered in New York, NY.

Latest PTMN News From Around the Web

Below are the latest news stories about PORTMAN RIDGE FINANCE CORP that investors may wish to consider to help them evaluate PTMN as an investment opportunity.

12 Extreme Dividend Stocks With Upside PotentialIn this article, we will take a detailed look at the 12 Extreme Dividend Stocks With Upside Potential. For a quick overview of such stocks, read our article 5 Extreme Dividend Stocks With Upside Potential. Despite talk of possible rate cuts from the Federal Reserve next year, the macro environment remains highly volatile with several analysts saying the US economy […] |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

Portman Ridge Finance Corporation (NASDAQ:PTMN) Q3 2023 Earnings Call TranscriptPortman Ridge Finance Corporation (NASDAQ:PTMN) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Welcome to Portman Ridge Finance Corporation’s Third Quarter 2023 Earnings Conference Call. An earnings press release was distributed yesterday, November 8, after market close. A copy of the release, along with an earnings presentation is available on the company’s website at […] |

Q3 2023 Portman Ridge Finance Corp Earnings CallQ3 2023 Portman Ridge Finance Corp Earnings Call |

Portman Ridge Finance Corporation Announces Third Quarter 2023 Financial ResultsReports Strong Performance with Increases in Net Asset Value Per Share Quarter-over-Quarter, Core Investment Income and Net Investment Income Year-over-Year, While Also Continuing Share Repurchase Program in the Third Quarter of 2023 Announces Quarterly Distribution of $0.69 Per Share in the Fourth Quarter of 2023, Marking a $0.19 per Share Increase in the Total Distribution for the Full Year 2023, a 7.4% Increase as Compared to the Full Year 2022 NEW YORK, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Port |

PTMN Price Returns

| 1-mo | 2.75% |

| 3-mo | 4.65% |

| 6-mo | 12.40% |

| 1-year | 11.43% |

| 3-year | 51.92% |

| 5-year | 109.75% |

| YTD | 16.60% |

| 2023 | -8.99% |

| 2022 | 3.80% |

| 2021 | 82.89% |

| 2020 | 7.18% |

| 2019 | -31.47% |

PTMN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PTMN

Want to do more research on Portman Ridge Finance Corp's stock and its price? Try the links below:Portman Ridge Finance Corp (PTMN) Stock Price | Nasdaq

Portman Ridge Finance Corp (PTMN) Stock Quote, History and News - Yahoo Finance

Portman Ridge Finance Corp (PTMN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...