Palatin Technologies, Inc. (PTN): Price and Financial Metrics

PTN Price/Volume Stats

| Current price | $1.70 | 52-week high | $5.65 |

| Prev. close | $1.81 | 52-week low | $1.43 |

| Day low | $1.66 | Volume | 67,121 |

| Day high | $1.81 | Avg. volume | 402,835 |

| 50-day MA | $1.86 | Dividend yield | N/A |

| 200-day MA | $2.31 | Market Cap | 27.43M |

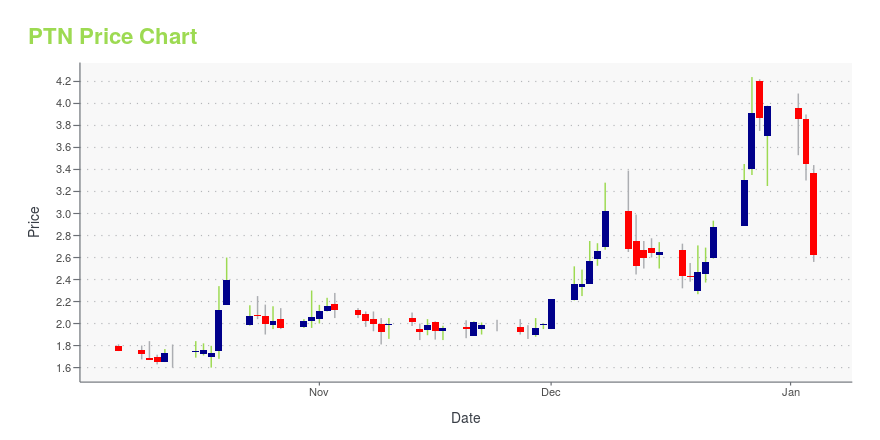

PTN Stock Price Chart Interactive Chart >

Palatin Technologies, Inc. (PTN) Company Bio

Palatin Technologies, Inc., a specialized biopharmaceutical company, develops targeted receptor-specific therapeutics for the treatment of various diseases in the United States. The company's lead product is Vyleesi, a melanocortin receptor agonist for the treatment of premenopausal women with acquired, generalized hypoactive sexual desire disorder. It is also developing oral PL8177, a selective melanocortin receptor (MCr) 1 agonist peptide that has completed Phase I clinical trial for the treatment of inflammatory bowel diseases; and systemic PL8177, which has completed Phase I clinical trial for treating non-infectious uveitis and COVID-19. In addition, the company engages in the development of PL9643, a peptide melanocortin agonist active at multiple MCrs, including MC1r and MC5r for anti-inflammatory ocular indications, such as dry eye disease; and melanocortin peptides for diabetic retinopathy. Further, it is developing PL3994, a natriuretic peptide receptor (NPR)-A agonist and synthetic mimetic of the endogenous neuropeptide hormone atrial natriuretic peptide for cardiovascular indications; and PL5028, a dual NPR-A and NPR-C agonist to treat cardiovascular and fibrotic diseases, including reducing cardiac hypertrophy and fibrosis. The company was founded in 1986 and is based in Cranbury, New Jersey.

Latest PTN News From Around the Web

Below are the latest news stories about PALATIN TECHNOLOGIES INC that investors may wish to consider to help them evaluate PTN as an investment opportunity.

Analysts Say 3 Stocks Have a Combined Upside of 3000%These high-risk, high-reward bets could be at an inflection point before their growth takes off next year. |

Palatin Completes Sale of Vyleesi® to Cosette Pharmaceuticals for up to $171 MillionPalatin Technologies, Inc. (NYSE American: PTN), a biopharmaceutical company developing first-in-class medicines based on molecules that modulate the activity of the melanocortin receptor system, today announced the sale of Vyleesi® to Cosette Pharmaceuticals, a US-based, speciality pharmaceutical company, for up to $171 million, consisting of an upfront purchase price of $12 million plus contingent, sales-based milestone payments of up to $159 million. Vyleesi is the first and only as-needed tr |

Palatin Receives Notice of Acceptance of the Listing Standards Compliance Plan from NYSE AmericanPalatin Technologies, Inc. (NYSE American: PTN), a biopharmaceutical company developing first-in-class medicines based on molecules that modulate the activity of the melanocortin receptor system, today announced it received a notice from the staff of NYSE American LLC (the "Exchange") approving Palatin's plan (the "Plan") to come into compliance with the Exchange's continued listing standards under Section 1003(a)(i) and (ii) of the NYSE American Company Guide. Section 1003(a)(i) requires a list |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to dive into the biggest pre-market stock movers for Friday morning as we check out the winners and losers today! |

Palatin Technologies, Inc. (AMEX:PTN) Q1 2024 Earnings Call TranscriptPalatin Technologies, Inc. (AMEX:PTN) Q1 2024 Earnings Call Transcript November 14, 2023 Operator: Greetings. Welcome to Palatin’s First Quarter Fiscal Year 2024 Operating Results Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. Before […] |

PTN Price Returns

| 1-mo | -6.59% |

| 3-mo | -6.59% |

| 6-mo | -60.74% |

| 1-year | -7.61% |

| 3-year | -86.40% |

| 5-year | -92.71% |

| YTD | -57.29% |

| 2023 | 55.47% |

| 2022 | -79.98% |

| 2021 | -24.30% |

| 2020 | -13.60% |

| 2019 | 10.17% |

Continue Researching PTN

Want to see what other sources are saying about Palatin Technologies Inc's financials and stock price? Try the links below:Palatin Technologies Inc (PTN) Stock Price | Nasdaq

Palatin Technologies Inc (PTN) Stock Quote, History and News - Yahoo Finance

Palatin Technologies Inc (PTN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...