Petros Pharmaceuticals Inc. (PTPI): Price and Financial Metrics

PTPI Price/Volume Stats

| Current price | $0.03 | 52-week high | $16.25 |

| Prev. close | $0.03 | 52-week low | $0.02 |

| Day low | $0.03 | Volume | 312,000 |

| Day high | $0.03 | Avg. volume | 5,994,309 |

| 50-day MA | $0.07 | Dividend yield | N/A |

| 200-day MA | $4.51 | Market Cap | 856.90K |

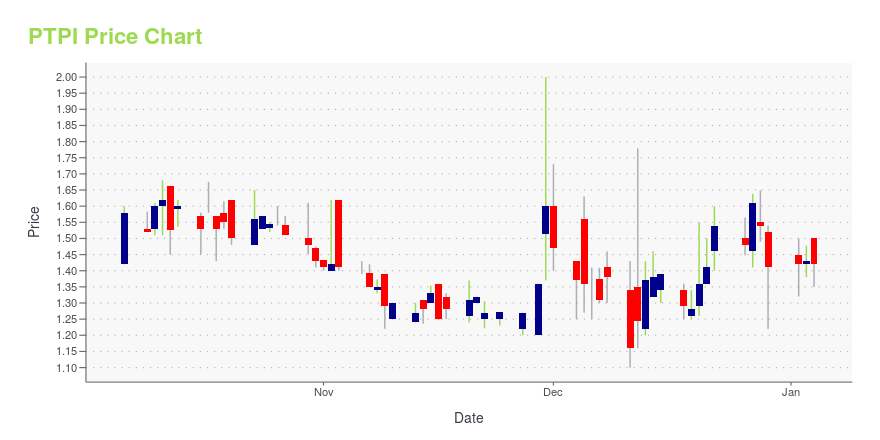

PTPI Stock Price Chart Interactive Chart >

Petros Pharmaceuticals Inc. (PTPI) Company Bio

Petros Pharmaceuticals, Inc. engages in men's health therapeutics. It is involved in sales, marketing, regulatory and medical affairs, finance, trade relations, pharmacovigilance, market access relations, manufacturing, and distribution. It operates through the Prescription Medications and Medical Devices segments. The Prescription Medications segment handles Stendra, a FDA approved PDE-5 inhibitor prescription medication for the treatment of erectile dysfunction, and H100, a topical formulation candidate for the treatment of acute Peyronie's disease. The Medical Devices segment consists of vacuum erection devices. The company was founded on May 14, 2020 and is headquartered in New York, NY.

PTPI Price Returns

| 1-mo | -3.23% |

| 3-mo | -97.01% |

| 6-mo | -99.60% |

| 1-year | -99.74% |

| 3-year | -99.99% |

| 5-year | N/A |

| YTD | -99.70% |

| 2024 | -72.06% |

| 2023 | -39.48% |

| 2022 | -93.00% |

| 2021 | -24.32% |

| 2020 | N/A |

Loading social stream, please wait...