Prudential PLC ADR (PUK): Price and Financial Metrics

PUK Price/Volume Stats

| Current price | $18.01 | 52-week high | $28.50 |

| Prev. close | $17.70 | 52-week low | $17.12 |

| Day low | $17.69 | Volume | 775,100 |

| Day high | $18.01 | Avg. volume | 820,388 |

| 50-day MA | $18.90 | Dividend yield | 3.16% |

| 200-day MA | $20.26 | Market Cap | 24.76B |

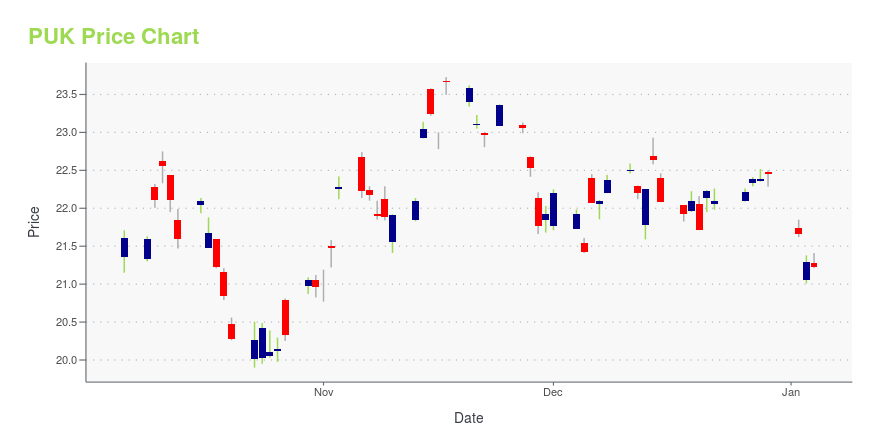

PUK Stock Price Chart Interactive Chart >

Prudential PLC ADR (PUK) Company Bio

Prudential plc is a British multinational insurance company headquartered in London, England. It was founded in London in May 1848 to provide loans to professional and working people. (Source:Wikipedia)

Latest PUK News From Around the Web

Below are the latest news stories about PRUDENTIAL PLC that investors may wish to consider to help them evaluate PUK as an investment opportunity.

Financial Services Roundup: Market TalkGain insight on Westpac, Cboe Global Markets, Aviva and more in the latest Market Talks covering Financial Services. |

Prudential’s Nine-Month Sales SoaredPrudential said its nine-month sales rose 40%, led by gains in Hong Kong, with the group’s new business profit jumping to more than $2 billion. |

Prudential shares see modest rise in robust trading sessionShares of Prudential PLC (LSE:PRU) experienced a modest uptick of 0.63%, closing at £9.24 in Wednesday's trading session, according to data from Dow Jones and FactSet, processed by Automated Insights. This positive movement was in line with the broader market trend, as the FTSE 100 Index also saw an increase, rising by 0.93% to reach 7,731.65. |

U.K. central bank hikes rates to 15-year high amid rising inflation and banking sector impairmentsIn an effort to curb soaring inflation, the central bank has escalated its primary interest rate from 0.1% in December 2021 to a 15-year peak of 5.25%. Further, the market anticipates another increase later this week to 5.5%, marking the 14th consecutive rise since August. This series of hikes is causing an uptick in impairments within the British banking sector, as noted by Sam Woods, Deputy Governor of the Bank of England on Tuesday. |

BlackRock's largest Singapore-based ETF launch targets Asian climate actionBlackRock (NYSE:BLK), the world's largest asset manager, has launched its largest equity exchange-traded fund (ETF) in Singapore to date. The iShares MSCI Asia ex-Japan Climate Action ETF, valued at $426 million, was launched on Monday and is aimed at investors looking to integrate low-carbon transition objectives into their portfolios. The ETF is based on Asian companies committed to reducing carbon emissions as part of the global transition towards renewable energy and sustainable infrastructu |

PUK Price Returns

| 1-mo | -5.31% |

| 3-mo | -1.64% |

| 6-mo | -16.42% |

| 1-year | -34.02% |

| 3-year | -49.42% |

| 5-year | -46.96% |

| YTD | -18.58% |

| 2023 | -17.04% |

| 2022 | -19.12% |

| 2021 | -6.04% |

| 2020 | -0.90% |

| 2019 | 27.87% |

PUK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PUK

Want to see what other sources are saying about Prudential Plc's financials and stock price? Try the links below:Prudential Plc (PUK) Stock Price | Nasdaq

Prudential Plc (PUK) Stock Quote, History and News - Yahoo Finance

Prudential Plc (PUK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...