Puyi Inc. - (PUYI): Price and Financial Metrics

PUYI Price/Volume Stats

| Current price | $8.96 | 52-week high | $9.70 |

| Prev. close | $6.69 | 52-week low | $1.96 |

| Day low | $6.95 | Volume | 13,600 |

| Day high | $9.00 | Avg. volume | 7,181 |

| 50-day MA | $6.69 | Dividend yield | N/A |

| 200-day MA | $5.65 | Market Cap | 540.47M |

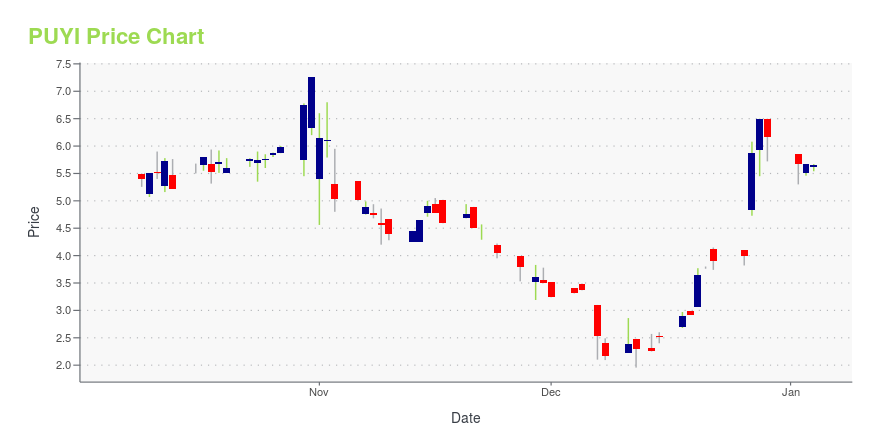

PUYI Stock Price Chart Interactive Chart >

Puyi Inc. - (PUYI) Company Bio

Puyi, Inc. engages in the provision of distribution and managing wealth management services. It offers wealth management, corporate finance, and asset management services. The company was founded by Hai Feng Yu on August 6, 2018 and is headquartered in Guangzhou, China.

Latest PUYI News From Around the Web

Below are the latest news stories about PUYI INC that investors may wish to consider to help them evaluate PUYI as an investment opportunity.

Puyi Announces Share Exchange Transactions with Certain Shareholders of FanhuaGUANGZHOU, China, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Puyi Inc. (NASDAQ: PUYI) (“Puyi”), a leading third-party wealth management services provider in China, today announced that it has entered into certain share exchange agreements with certain shareholders of Fanhua Inc. (“Fanhua,” NASDAQ: FANH), including Mr. Yinan Hu, co-chairman and CEO of FANHUA, certain executive officers of Fanhua, certain employees of Fanhua and certain other shareholders (collectively “Fanhua’s Participating Shareholders” |

FANHUA Announces Share Exchange Transaction Between Certain Shareholders and Puyi Inc.GUANGZHOU, China, Dec. 27, 2023 (GLOBE NEWSWIRE) -- FANHUA Inc. (“FANHUA” or “the Company”) (Nasdaq: FANH), a leading independent financial services provider in China, today announced that certain of FANHUA’s shareholders (collectively, “FANHUA Participating Shareholders”), entered into share exchange agreements with Puyi Inc. (Nasdaq: PUYI), a leading third party wealth management service provider in China. The FANHUA Participating Shareholders consist of Mr. Yinan Hu, co-chairman of the board |

FANHUA To Exchange Its 4.5% Stake in Puyi for 15.4% Stake in Puyi’s Wholly-owned Fund Sales CompanyGUANGZHOU, China, Dec. 22, 2023 (GLOBE NEWSWIRE) -- FANHUA Inc. (NASDAQ: FANH) (“FANHUA,” or the “Company”), a leading independent financial services provider in China, today announced that it entered into a share repurchase agreement with Puyi Inc. (Nasdaq: PUYI) (“Puyi”) on December 22, 2023, pursuant to which FANHUA agreed to transfer all of its 4.46% equity interests in Puyi, or 4,033,600 ordinary shares of Puyi, back to Puyi. Concurrently, a wholly-owned subsidiary of FANHUA entered into a |

Puyi Announces to Repurchase 4.46% Stake from FanhuaGUANGZHOU, China, Dec. 22, 2023 (GLOBE NEWSWIRE) -- Puyi Inc. (NASDAQ: PUYI) (“Puyi”), a leading third-party wealth management services provider in China, today announced that it entered into a share repurchase agreement with Fanhua Inc. (“Fanhua”), pursuant to which Puyi intends to repurchase 4,033,600 ordinary shares of Puyi beneficially owned by Fanhua, representing 4.46% of Puyi’s share capital (“Share Repurchase”). Concurrently, Puyi entered into a share transfer agreement with Fanhua, purs |

Puyi Inc.'s (NASDAQ:PUYI) 45% Share Price Plunge Could Signal Some RiskThe Puyi Inc. ( NASDAQ:PUYI ) share price has fared very poorly over the last month, falling by a substantial 45%. For... |

PUYI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 51.35% |

| 1-year | N/A |

| 3-year | 81.74% |

| 5-year | -25.77% |

| YTD | 45.22% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | N/A |

Continue Researching PUYI

Want to see what other sources are saying about Puyi Inc's financials and stock price? Try the links below:Puyi Inc (PUYI) Stock Price | Nasdaq

Puyi Inc (PUYI) Stock Quote, History and News - Yahoo Finance

Puyi Inc (PUYI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...