Quanta Services Inc. (PWR): Price and Financial Metrics

PWR Price/Volume Stats

| Current price | $386.51 | 52-week high | $387.37 |

| Prev. close | $373.41 | 52-week low | $227.08 |

| Day low | $374.96 | Volume | 869,600 |

| Day high | $387.37 | Avg. volume | 1,483,891 |

| 50-day MA | $342.58 | Dividend yield | 0.11% |

| 200-day MA | $310.72 | Market Cap | 57.31B |

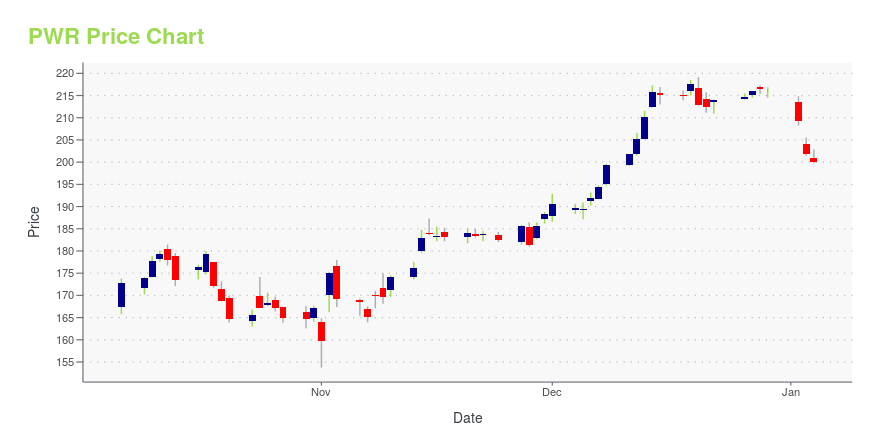

PWR Stock Price Chart Interactive Chart >

Quanta Services Inc. (PWR) Company Bio

Quanta Services is an American corporation that provides infrastructure services for electric power, pipeline, industrial and communications industries. Capabilities include the planning, design, installation, program management, maintenance and repair of most types of network infrastructure. In June 2009, Quanta Services was added to the S&P 500 index, replacing Ingersoll-Rand. (Source:Wikipedia)

PWR Price Returns

| 1-mo | 7.52% |

| 3-mo | 61.44% |

| 6-mo | 17.89% |

| 1-year | 53.25% |

| 3-year | 207.53% |

| 5-year | 901.20% |

| YTD | 22.41% |

| 2024 | 46.60% |

| 2023 | 51.70% |

| 2022 | 24.63% |

| 2021 | 59.50% |

| 2020 | 77.74% |

PWR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PWR

Want to do more research on Quanta Services Inc's stock and its price? Try the links below:Quanta Services Inc (PWR) Stock Price | Nasdaq

Quanta Services Inc (PWR) Stock Quote, History and News - Yahoo Finance

Quanta Services Inc (PWR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...