Quanta Services Inc. (PWR): Price and Financial Metrics

PWR Price/Volume Stats

| Current price | $256.73 | 52-week high | $286.87 |

| Prev. close | $248.81 | 52-week low | $153.74 |

| Day low | $253.75 | Volume | 642,338 |

| Day high | $259.15 | Avg. volume | 946,410 |

| 50-day MA | $266.51 | Dividend yield | 0.14% |

| 200-day MA | $228.36 | Market Cap | 37.58B |

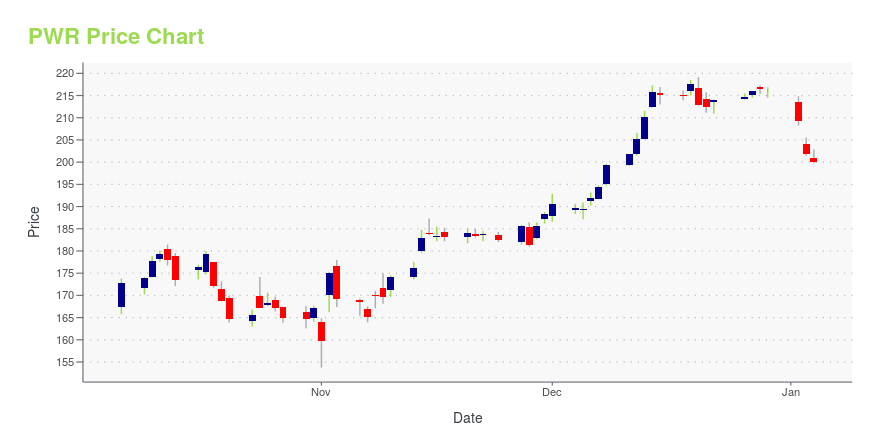

PWR Stock Price Chart Interactive Chart >

Quanta Services Inc. (PWR) Company Bio

Quanta Services is an American corporation that provides infrastructure services for electric power, pipeline, industrial and communications industries. Capabilities include the planning, design, installation, program management, maintenance and repair of most types of network infrastructure. In June 2009, Quanta Services was added to the S&P 500 index, replacing Ingersoll-Rand. (Source:Wikipedia)

Latest PWR News From Around the Web

Below are the latest news stories about QUANTA SERVICES INC that investors may wish to consider to help them evaluate PWR as an investment opportunity.

Earnings Growth & Price Strength Make Quanta Services (PWR) a Stock to WatchWondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List. |

Ranking The Top S&P 500 Stocks By 5-Year ReturnsDespite economic challenges, S&P 500 stocks have demonstrated resilience, delivering significant gains over time. |

5 Stocks to Watch on Their Recent Dividend HikeFive stocks that have recently raised dividends are: BMY, PWR, CARR, AVGO, OC. |

Returns On Capital At Quanta Services (NYSE:PWR) Have Hit The BrakesDid you know there are some financial metrics that can provide clues of a potential multi-bagger? Amongst other things... |

Why Is Aecom (ACM) Up 6.7% Since Last Earnings Report?Aecom (ACM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

PWR Price Returns

| 1-mo | -3.66% |

| 3-mo | -1.85% |

| 6-mo | 30.88% |

| 1-year | 27.52% |

| 3-year | 193.14% |

| 5-year | 588.83% |

| YTD | 19.05% |

| 2023 | 51.70% |

| 2022 | 24.63% |

| 2021 | 59.50% |

| 2020 | 77.74% |

| 2019 | 35.84% |

PWR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PWR

Want to do more research on Quanta Services Inc's stock and its price? Try the links below:Quanta Services Inc (PWR) Stock Price | Nasdaq

Quanta Services Inc (PWR) Stock Quote, History and News - Yahoo Finance

Quanta Services Inc (PWR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...