Praxair, Inc. (PX): Price and Financial Metrics

PX Price/Volume Stats

| Current price | $10.17 | 52-week high | $13.41 |

| Prev. close | $10.05 | 52-week low | $7.08 |

| Day low | $10.01 | Volume | 411,977 |

| Day high | $10.24 | Avg. volume | 691,663 |

| 50-day MA | $8.60 | Dividend yield | 1.41% |

| 200-day MA | $8.86 | Market Cap | 1.15B |

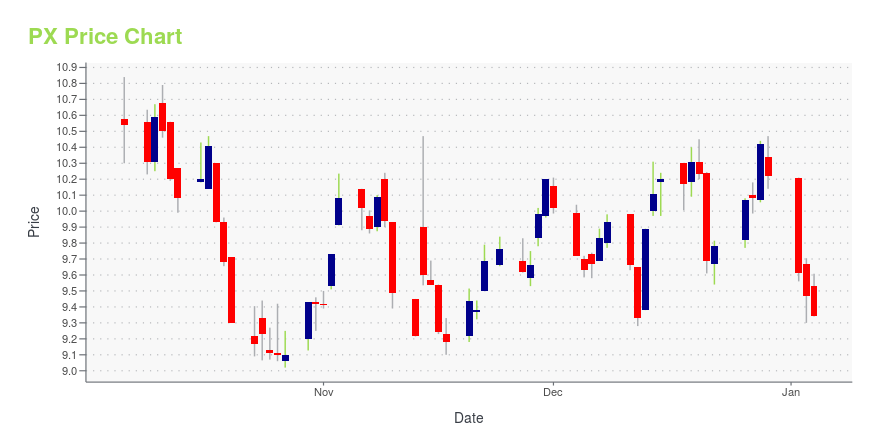

PX Stock Price Chart Interactive Chart >

Praxair, Inc. (PX) Company Bio

Praxair Inc. produces, sells and distributes atmospheric, process and specialty gases, and high-performance surface coatings. Praxair products, services and technologies are making our planet more productive by bringing efficiency and environmental benefits to a wide variety of industries, including aerospace, chemicals, food and beverage, electronics, energy, healthcare, manufacturing, primary metals and many others. The company was founded in 1907 and is based in Danbury, Connecticut.

Latest PX News From Around the Web

Below are the latest news stories about P10 INC that investors may wish to consider to help them evaluate PX as an investment opportunity.

Why It Might Not Make Sense To Buy P10, Inc. (NYSE:PX) For Its Upcoming DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see P10, Inc... |

Kayne Anderson Private Credit Announces Strategic Minority Investment From Bonaccord Capital PartnersCHICAGO, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Kayne Anderson Private Credit (“KAPC” or the "Firm"), a middle-market private credit platform with $6 billion of assets under management, is pleased to announce that Bonaccord Capital Partners (“Bonaccord” or “BCP”) has made a passive minority investment in the Firm. Bonaccord, a subsidiary of P10, Inc. (NYSE: PX), is a private equity platform dedicated to acquiring non-control equity interests in leading private markets investment firms. Kayne Anderson |

P10 (NYSE:PX) Has Announced A Dividend Of $0.0325The board of P10, Inc. ( NYSE:PX ) has announced that it will pay a dividend on the 20th of December, with investors... |

P10, Inc. (NYSE:PX) Q3 2023 Earnings Call TranscriptP10, Inc. (NYSE:PX) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Hello and welcome to the P10 Third Quarter 2023 Conference Call. My name is Latif and I will be coordinating your call today. At this time, all participants are in a listen-only mode. After the speaker presentation, there will be a question-and-answer session. […] |

Q3 2023 P10 Inc Earnings CallQ3 2023 P10 Inc Earnings Call |

PX Price Returns

| 1-mo | 22.53% |

| 3-mo | 36.92% |

| 6-mo | 11.11% |

| 1-year | -10.91% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 0.34% |

| 2023 | -3.03% |

| 2022 | -23.07% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

PX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...