Qorvo Inc. (QRVO): Price and Financial Metrics

QRVO Price/Volume Stats

| Current price | $122.01 | 52-week high | $130.99 |

| Prev. close | $118.67 | 52-week low | $80.62 |

| Day low | $120.38 | Volume | 1,099,466 |

| Day high | $123.66 | Avg. volume | 1,338,475 |

| 50-day MA | $111.23 | Dividend yield | N/A |

| 200-day MA | $106.32 | Market Cap | 11.59B |

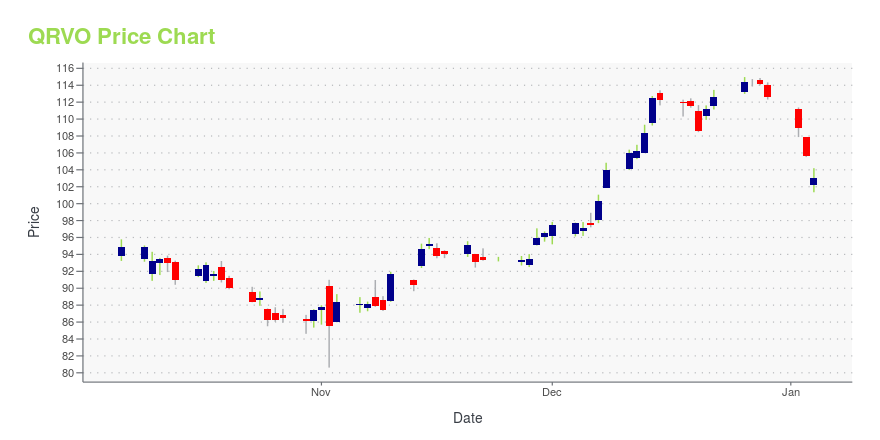

QRVO Stock Price Chart Interactive Chart >

Qorvo Inc. (QRVO) Company Bio

Qorvo is an American semiconductor company that designs, manufactures, and supplies radio-frequency systems for applications that drive wireless and broadband communications, as well as foundry services. The company, which trades on NASDAQ, was created by the merger of TriQuint Semiconductor and RF Micro Devices, which was announced in 2014 and completed on January 1, 2015. The headquarters for the company originally were in both Hillsboro, Oregon (home of TriQuint), and Greensboro, North Carolina (home of RFMD), but in mid-2016 the company began referring to its North Carolina site as its exclusive headquarters. (Source:Wikipedia)

Latest QRVO News From Around the Web

Below are the latest news stories about QORVO INC that investors may wish to consider to help them evaluate QRVO as an investment opportunity.

Qorvo (NASDAQ:QRVO) ascends 3.1% this week, taking five-year gains to 106%When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can... |

Best Semiconductor Stocks 2024: 3 Names to Add to Your Must-Buy ListSemiconductor stocks have been outperforming the market, but which ones are the new winners? |

Chip Manufacturers Are Expanding, but 1 Top Chip Stock Is Selling Fabs -- Is It a Top Buy for 2024?Qorvo is going against the grain and getting smaller to forge ahead with future growth plans. |

3 Stocks to Buy on Upbeat Semiconductor Sales Forecast for 2024Stocks like Qorvo, Inc. (QRVO), NVIDIA Corporation (NVDA) and Intel Corporation (INTC) are poised to benefit in 2024 as semiconductor sales gather pace. |

Qorvo (QRVO) Divests China Assets to Trim Capital IntensityThrough selling its Chinese manufacturing facilities to Luxshare, Qorvo (QRVO) is aiming to streamline its supply chain network. |

QRVO Price Returns

| 1-mo | 7.18% |

| 3-mo | 4.51% |

| 6-mo | 17.68% |

| 1-year | 14.05% |

| 3-year | -34.81% |

| 5-year | 62.85% |

| YTD | 8.35% |

| 2023 | 24.24% |

| 2022 | -42.04% |

| 2021 | -5.94% |

| 2020 | 43.05% |

| 2019 | 91.39% |

Continue Researching QRVO

Want to do more research on Qorvo Inc's stock and its price? Try the links below:Qorvo Inc (QRVO) Stock Price | Nasdaq

Qorvo Inc (QRVO) Stock Quote, History and News - Yahoo Finance

Qorvo Inc (QRVO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...