Freightcar America, Inc. (RAIL): Price and Financial Metrics

RAIL Price/Volume Stats

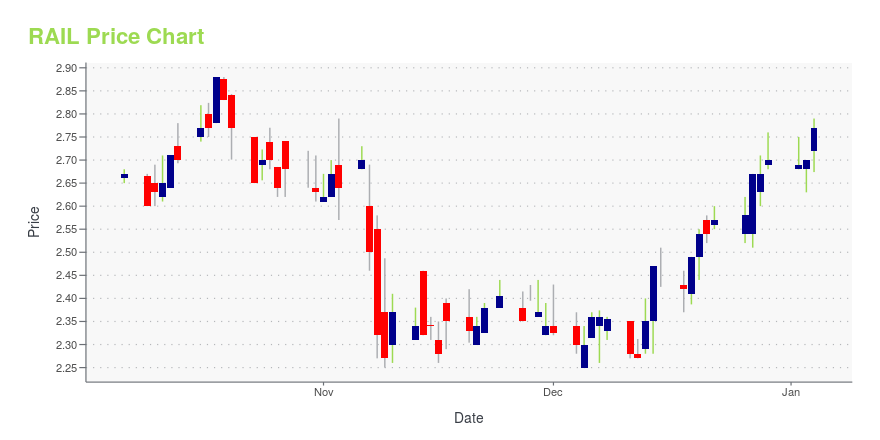

| Current price | $3.26 | 52-week high | $4.26 |

| Prev. close | $3.19 | 52-week low | $2.25 |

| Day low | $3.18 | Volume | 15,919 |

| Day high | $3.29 | Avg. volume | 35,197 |

| 50-day MA | $3.49 | Dividend yield | N/A |

| 200-day MA | $3.09 | Market Cap | 61.00M |

RAIL Stock Price Chart Interactive Chart >

Freightcar America, Inc. (RAIL) Company Bio

FreightCar America designs, manufactures, and sells aluminum-bodied railcars and coal cars that transport various non-liquid commodities and products primarily in North America. The company operates through two segments, Manufacturing and Services. The company was founded in 1901 and is based in Chicago, Illinois.

Latest RAIL News From Around the Web

Below are the latest news stories about FREIGHTCAR AMERICA INC that investors may wish to consider to help them evaluate RAIL as an investment opportunity.

Positive Signs As Multiple Insiders Buy FreightCar America StockIt is usually uneventful when a single insider buys stock. However, When quite a few insiders buy shares, as it... |

FreightCar America's (NASDAQ:RAIL) Returns On Capital Are Heading HigherIf you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two... |

FreightCar America, Trinity Industries take hit from migrant crossingsHigh numbers of migrant crossings in September disrupted freight rail operations, including Trinity Industries’ and FreightCar America’s ability to send new rail cars into the U.S., executives said on recent earnings calls. The post FreightCar America, Trinity Industries take hit from migrant crossings appeared first on FreightWaves. |

FreightCar America, Inc. (NASDAQ:RAIL) Q3 2023 Earnings Call TranscriptFreightCar America, Inc. (NASDAQ:RAIL) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Greetings, and welcome to FreightCar America Third Quarter Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Victoria Roseman, Investor Relations. Thank you, Ms. Roseman. You may begin. Victoria […] |

Q3 2023 FreightCar America Inc Earnings CallQ3 2023 FreightCar America Inc Earnings Call |

RAIL Price Returns

| 1-mo | -11.65% |

| 3-mo | -9.44% |

| 6-mo | 17.90% |

| 1-year | 13.59% |

| 3-year | -39.52% |

| 5-year | -38.95% |

| YTD | 20.74% |

| 2023 | -15.63% |

| 2022 | -13.28% |

| 2021 | 53.11% |

| 2020 | 16.43% |

| 2019 | -69.06% |

Continue Researching RAIL

Want to see what other sources are saying about FreightCar America Inc's financials and stock price? Try the links below:FreightCar America Inc (RAIL) Stock Price | Nasdaq

FreightCar America Inc (RAIL) Stock Quote, History and News - Yahoo Finance

FreightCar America Inc (RAIL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...