Rocky Brands, Inc. (RCKY): Price and Financial Metrics

RCKY Price/Volume Stats

| Current price | $37.23 | 52-week high | $40.14 |

| Prev. close | $37.08 | 52-week low | $11.77 |

| Day low | $36.68 | Volume | 34,700 |

| Day high | $37.80 | Avg. volume | 39,362 |

| 50-day MA | $36.17 | Dividend yield | 1.7% |

| 200-day MA | $28.60 | Market Cap | 276.36M |

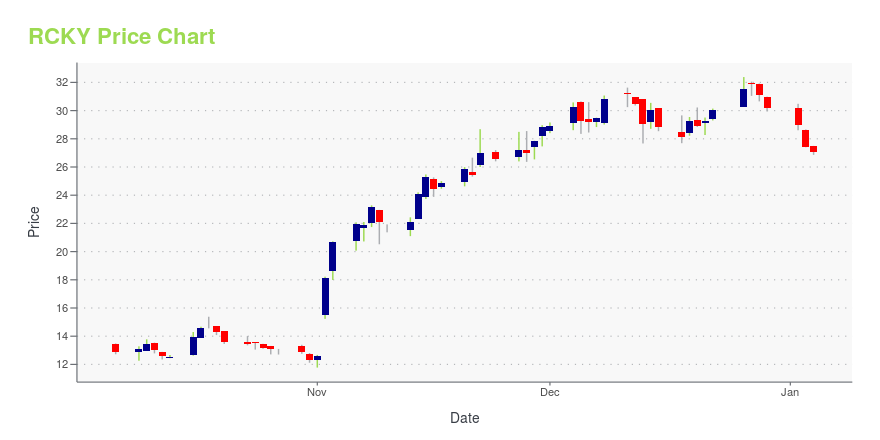

RCKY Stock Price Chart Interactive Chart >

Rocky Brands, Inc. (RCKY) Company Bio

Rocky Brands designs, manufactures, and markets footwear and apparel under the Rocky, Georgia Boot, Durango, Lehigh, Creative Recreation, and Michelin brand names in the United States, Canada, and internationally. The company was founded in 1932 and is based in Nelsonville, Ohio.

Latest RCKY News From Around the Web

Below are the latest news stories about ROCKY BRANDS INC that investors may wish to consider to help them evaluate RCKY as an investment opportunity.

4 Solid Stocks to Buy on Rise in Personal Income, SpendingDiscretionary stocks like Snap-on (SNA), Rocky Brands (RCKY), Royal Caribbean Cruises (RCL), Live Nation Entertainment (LYV) and Hilton Worldwide Holdings (HLT) are poised to benefit from the jump in personal income and spending. |

Carter's (CRI) Continues to Focus on Pricing: Stock to GainCarter's (CRI) anticipates lower product costs, which are expected to enable it to strengthen its product offerings and sharpen price points, thereby improving profitability in the next year. |

Are Investors Undervaluing Rocky Brands (RCKY) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Insider Sell Alert: Director Mike Brooks Sells 4,000 Shares of Rocky Brands Inc (RCKY)In a recent transaction on December 13, 2023, Director Mike Brooks sold 4,000 shares of Rocky Brands Inc (NASDAQ:RCKY), a leading company in the design, manufacture, and marketing of premium footwear and apparel. |

Despite Fast-paced Momentum, Rocky Brands (RCKY) Is Still a Bargain StockIf you are looking for stocks that have gained strong momentum recently but are still trading at reasonable prices, Rocky Brands (RCKY) could be a great choice. It is one of the several stocks that passed through our 'Fast-Paced Momentum at a Bargain' screen. |

RCKY Price Returns

| 1-mo | 5.86% |

| 3-mo | 41.13% |

| 6-mo | 36.90% |

| 1-year | 70.35% |

| 3-year | -24.58% |

| 5-year | 32.98% |

| YTD | 24.65% |

| 2023 | 31.37% |

| 2022 | -39.48% |

| 2021 | 43.66% |

| 2020 | -2.41% |

| 2019 | 15.41% |

RCKY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RCKY

Want to do more research on Rocky Brands Inc's stock and its price? Try the links below:Rocky Brands Inc (RCKY) Stock Price | Nasdaq

Rocky Brands Inc (RCKY) Stock Quote, History and News - Yahoo Finance

Rocky Brands Inc (RCKY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...