Redhill Biopharma Ltd. (RDHL): Price and Financial Metrics

RDHL Price/Volume Stats

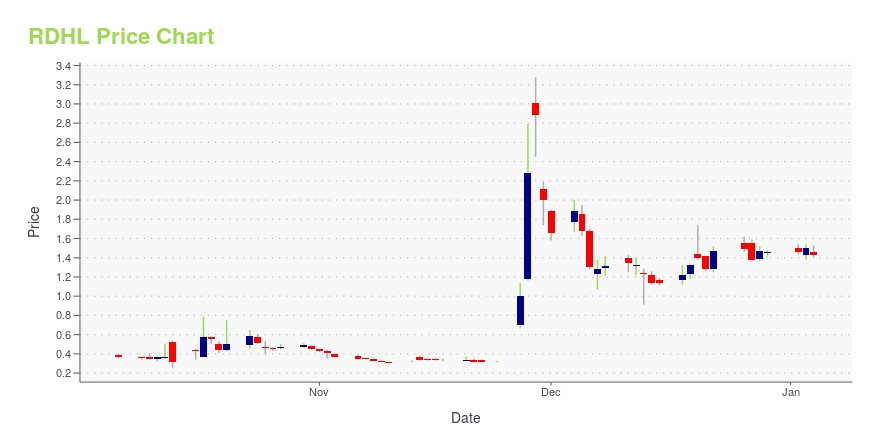

| Current price | $0.40 | 52-week high | $3.28 |

| Prev. close | $0.38 | 52-week low | $0.26 |

| Day low | $0.37 | Volume | 706,600 |

| Day high | $0.43 | Avg. volume | 735,188 |

| 50-day MA | $0.41 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 11.79M |

RDHL Stock Price Chart Interactive Chart >

Redhill Biopharma Ltd. (RDHL) Company Bio

RedHill Biopharma Ltd. focuses on the development and acquisition of late clinical-stage, proprietary, and orally-administered drugs for the treatment of inflammatory and gastrointestinal diseases, including gastrointestinal cancers in Israel. The company was founded in 2009 and is based in Tel Aviv, Israel.

Latest RDHL News From Around the Web

Below are the latest news stories about REDHILL BIOPHARMA LTD that investors may wish to consider to help them evaluate RDHL as an investment opportunity.

RedHill and U.S. Army Announce Opaganib and RHB-107 Combinations with Remdesivir Show Distinct Synergistic Effect Against EbolaRedHill Biopharma Ltd. (Nasdaq: RDHL) ("RedHill" or the "Company"), a specialty biopharmaceutical company, today announced that its two novel, oral host-directed investigational drugs, opaganib[1] and RHB-107 (upamostat)[2], demonstrated robust synergistic effect when combined individually with remdesivir (Veklury®)[3], significantly improving viral inhibition while maintaining cell viability, in a new U.S. Army-funded and conducted Ebola virus in vitro study. |

RedHill Biopharma Regains Compliance with Nasdaq Minimum Bid Price RequirementRedHill Biopharma Ltd. (Nasdaq: RDHL) ("RedHill" or the "Company"), a specialty biopharmaceutical company, today announced that it received confirmation from The Nasdaq Stock Market LLC ("Nasdaq") that it had regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5450(a)(1) for continued Nasdaq listing, and is now compliant with applicable listing standards for continued Nasdaq listing. To regain compliance with Nasdaq Listing Rule 5550(a)(2), the Company was requir |

RedHill Announces New, Non-Dilutive External Funding of Entire RHB-107 COVID-19 300-Patient Phase 2 StudyRedHill Biopharma Ltd. (Nasdaq: RDHL) ("RedHill" or the "Company"), a specialty biopharmaceutical company, today announced new non-dilutive external funding, additional to the previously announced U.S. Government funding, which now covers the entirety of the RHB-107 (upamostat) arm of the ACESO PROTECT adaptive platform trial for early COVID-19 outpatient treatment. This additional funding amounts to approximately $4.8M directed towards evaluation of RHB-107 in the PROTECT study. |

Why Is ImmunoGen (IMGN) Stock Up 81% Today?ImmunoGen stock is taking off on news that AbbVie is acquiring all outstanding shares of IMGN in a $10.1 billion acquisition deal. |

Why Is Redhill Biopharma (RDHL) Stock Down 27% Today?Redhill Biopharma stock is falling on Thursday as shares of RDHL give up some of the gains they made throughout the week. |

RDHL Price Returns

| 1-mo | 7.50% |

| 3-mo | -6.54% |

| 6-mo | -41.19% |

| 1-year | -67.21% |

| 3-year | -99.84% |

| 5-year | -99.86% |

| YTD | -72.60% |

| 2023 | -73.98% |

| 2022 | -94.56% |

| 2021 | -68.07% |

| 2020 | 33.11% |

| 2019 | 9.37% |

Continue Researching RDHL

Want to see what other sources are saying about RedHill Biopharma Ltd's financials and stock price? Try the links below:RedHill Biopharma Ltd (RDHL) Stock Price | Nasdaq

RedHill Biopharma Ltd (RDHL) Stock Quote, History and News - Yahoo Finance

RedHill Biopharma Ltd (RDHL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...