Red Violet, Inc. (RDVT): Price and Financial Metrics

RDVT Price/Volume Stats

| Current price | $25.75 | 52-week high | $26.65 |

| Prev. close | $26.46 | 52-week low | $16.56 |

| Day low | $25.52 | Volume | 24,800 |

| Day high | $26.65 | Avg. volume | 45,636 |

| 50-day MA | $23.26 | Dividend yield | N/A |

| 200-day MA | $20.07 | Market Cap | 353.57M |

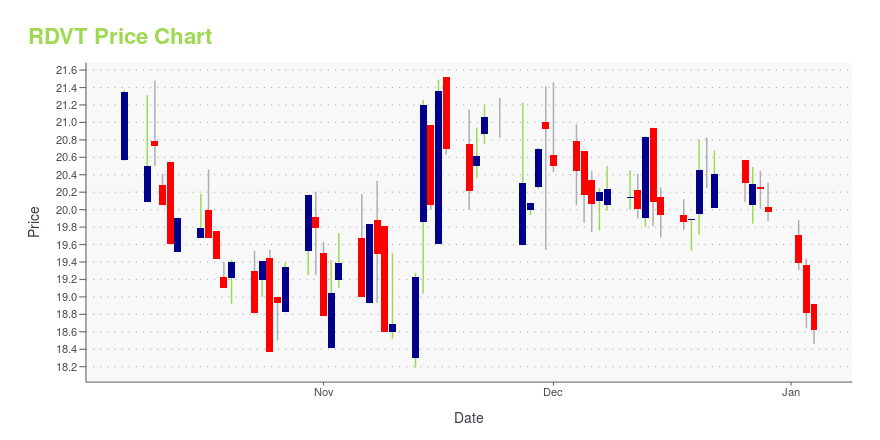

RDVT Stock Price Chart Interactive Chart >

Red Violet, Inc. (RDVT) Company Bio

Red Violet, Inc. operates as a software and services company. The Company specializes in big data analysis providing cloud-based mission-critical information solutions to enterprises in a variety of industries. Red Violet serves customers in the United States.

Latest RDVT News From Around the Web

Below are the latest news stories about RED VIOLET INC that investors may wish to consider to help them evaluate RDVT as an investment opportunity.

red violet Announces Additional $5 Million Share Repurchase AuthorizationBOCA RATON, Fla., Dec. 20, 2023 (GLOBE NEWSWIRE) -- Red Violet, Inc. (NASDAQ: RDVT), a leading analytics and information solutions provider, today announced that on December 19, 2023, its Board of Directors authorized the repurchase of an additional $5.0 million of the Company’s common stock. The authorization is effective immediately and is additive to the previous $5.0 million program, which had approximately $500,000 remaining authorized and available for repurchase as of December 19, 2023. S |

With 46% ownership, Red Violet, Inc. (NASDAQ:RDVT) has piqued the interest of institutional investorsKey Insights Institutions' substantial holdings in Red Violet implies that they have significant influence over the... |

Is Red Violet (RDVT) Going to Stay Flat Forever?Immersion Investment Partners, an investment management company, released its third quarter 2023 investor letter. A copy of the same can be downloaded here. The fund fell 8.62% in the third quarter compared to the 5.12% decline for the Russell 2000 Index. In addition, you can check the top 5 holdings of the fund to know its […] |

Estimating The Intrinsic Value Of Red Violet, Inc. (NASDAQ:RDVT)Key Insights Red Violet's estimated fair value is US$25.11 based on 2 Stage Free Cash Flow to Equity With US$20.70... |

Red Violet, Inc. (NASDAQ:RDVT) Q3 2023 Earnings Call TranscriptRed Violet, Inc. (NASDAQ:RDVT) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good day ladies and gentlemen. Welcome to Red Violet’s Third Quarter Earnings Conference Call. At this time all participants are in listen-only mode. Later we will conduct a question-and-answer session. [Operator Instructions] As a reminder, this call is being recorded. I would […] |

RDVT Price Returns

| 1-mo | 4.85% |

| 3-mo | 51.56% |

| 6-mo | 36.24% |

| 1-year | 22.10% |

| 3-year | 4.76% |

| 5-year | 74.69% |

| YTD | 28.94% |

| 2023 | -13.25% |

| 2022 | -42.00% |

| 2021 | 52.01% |

| 2020 | 41.06% |

| 2019 | 174.63% |

Continue Researching RDVT

Want to do more research on Red Violet Inc's stock and its price? Try the links below:Red Violet Inc (RDVT) Stock Price | Nasdaq

Red Violet Inc (RDVT) Stock Quote, History and News - Yahoo Finance

Red Violet Inc (RDVT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...