Rekor Systems, Inc. (REKR): Price and Financial Metrics

REKR Price/Volume Stats

| Current price | $1.87 | 52-week high | $4.15 |

| Prev. close | $1.78 | 52-week low | $1.28 |

| Day low | $1.79 | Volume | 759,745 |

| Day high | $1.87 | Avg. volume | 1,283,102 |

| 50-day MA | $1.64 | Dividend yield | N/A |

| 200-day MA | $2.38 | Market Cap | 159.62M |

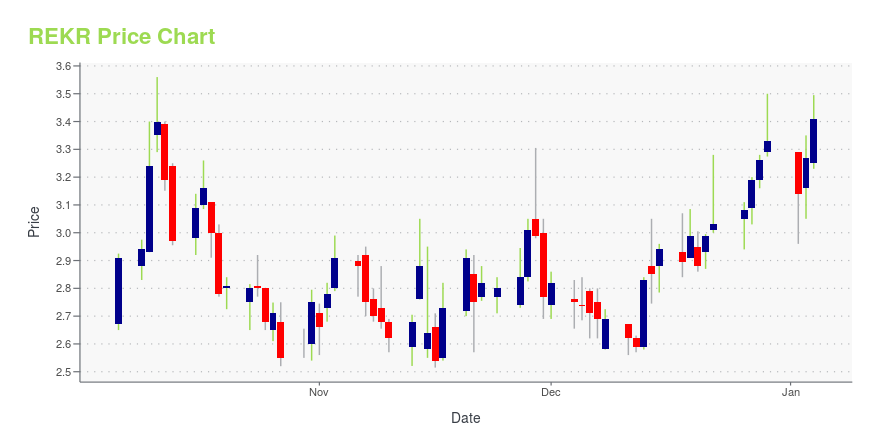

REKR Stock Price Chart Interactive Chart >

Rekor Systems, Inc. (REKR) Company Bio

Rekor Systems, Inc. provides license plate recognition and security solutions. The Company offers solutions for surveillance, electronic toll collection, parking operations, and traffic management. Rekor Systems serves customers in the United States.

Latest REKR News From Around the Web

Below are the latest news stories about REKOR SYSTEMS INC that investors may wish to consider to help them evaluate REKR as an investment opportunity.

These 8 Micro/Small Cap AI Stocks Index Are Still In A Bubble8 micro/small cap ($50M to $2B) AI & related stocks are still very much in bubble mode advancing above the sub-sector average of 2.5% last week while maintaining an advance of more than 100% YTD. |

Rekor Systems Announces Sale of $15 Million of Revenue Sharing Notes Due December 15, 2026 Priced at 13.25%Company to host a special investor conference call on December 14, 2023 to discuss its Revenue Sharing Notes programCOLUMBIA, MD / ACCESSWIRE / December 13, 2023 / Rekor Systems, Inc. (NASDAQ:REKR) ("Rekor" or the "Company"), a leader in developing ... |

Investing in Rekor Systems (NASDAQ:REKR) five years ago would have delivered you a 396% gainIt hasn't been the best quarter for Rekor Systems, Inc. ( NASDAQ:REKR ) shareholders, since the share price has fallen... |

7 Mid-Cap Stocks to Buy to Capture Massive AI GrowthInvestors should consider mid-cap AI stocks because they're in excellent position right now based on several factors. |

Rekor Systems Inc (REKR) Reports Record Q3 2023 Results with Strong Revenue GrowthCompany Achieves 35% Year-Over-Year Revenue Increase and Significant Reduction in Adjusted EBITDA Loss |

REKR Price Returns

| 1-mo | 25.50% |

| 3-mo | 4.47% |

| 6-mo | -45.64% |

| 1-year | -21.26% |

| 3-year | -74.87% |

| 5-year | -64.98% |

| YTD | -43.84% |

| 2023 | 177.50% |

| 2022 | -81.68% |

| 2021 | -18.84% |

| 2020 | 111.26% |

| 2019 | 487.69% |

Loading social stream, please wait...