Renren Inc. American Depositary Shares, each representing fifteen Class A ordinary shares (RENN): Price and Financial Metrics

RENN Price/Volume Stats

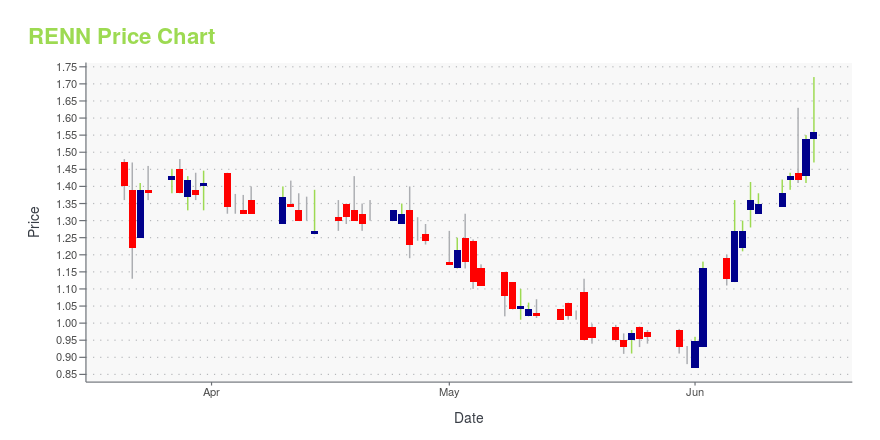

| Current price | $1.65 | 52-week high | $33.91 |

| Prev. close | $1.70 | 52-week low | $0.87 |

| Day low | $1.65 | Volume | 74,500 |

| Day high | $1.80 | Avg. volume | 89,887 |

| 50-day MA | $1.20 | Dividend yield | N/A |

| 200-day MA | $12.97 | Market Cap | 42.73M |

RENN Stock Price Chart Interactive Chart >

Renren Inc. American Depositary Shares, each representing fifteen Class A ordinary shares (RENN) Company Bio

Renren Inc. operates a social networking Internet platform in China. The company provides online advertising services, Internet value-added services (IVAS), including online talent show, VIP memberships, other IVAS, etc.; and online gaming services. The company was founded in 2002 and is based in Beijing, China.

Latest RENN News From Around the Web

Below are the latest news stories about RENREN INC that investors may wish to consider to help them evaluate RENN as an investment opportunity.

Renren Announces Proposed Name Change to Moatable, Inc.Renren Inc. (NYSE: RENN) ("Renren" or the "Company") announced today that it will change its name to Moatable, Inc., which is anticipated to become effective on June 22, 2023. |

Renren Announces Repurchase of SoftBank SharesRenren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates two U.S.-based SaaS businesses, Chime Technologies Inc.© and Trucker Path Inc.©, today announced the repurchase of 288 million ordinary shares of the Company held by SoftBank Group Capital Limited ("SoftBank"). |

Renren Reports First Quarter 2023 Financial ResultsRenren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates two US-based SaaS businesses, Chime Technologies Inc.© and Trucker Path Inc.©, today reported its first quarter 2023 financial results. |

Investing in Renren (NYSE:RENN) five years ago would have delivered you a 586% gainThese days it's easy to simply buy an index fund, and your returns should (roughly) match the market. A talented... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayWe're starting off the day with a breakdown of the biggest pre-market stock movers traders need to keep an eye on for Thursday! |

RENN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 129.36% |

| 5-year | 924.84% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 64.52% |

| 2021 | 207.75% |

| 2020 | 91.63% |

| 2019 | -46.11% |

Continue Researching RENN

Want to do more research on Renren Inc's stock and its price? Try the links below:Renren Inc (RENN) Stock Price | Nasdaq

Renren Inc (RENN) Stock Quote, History and News - Yahoo Finance

Renren Inc (RENN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...