Regions Financial Corp. (RF): Price and Financial Metrics

RF Price/Volume Stats

| Current price | $22.76 | 52-week high | $22.85 |

| Prev. close | $22.55 | 52-week low | $13.72 |

| Day low | $22.49 | Volume | 7,329,041 |

| Day high | $22.80 | Avg. volume | 8,236,869 |

| 50-day MA | $19.88 | Dividend yield | 4.29% |

| 200-day MA | $18.62 | Market Cap | 20.84B |

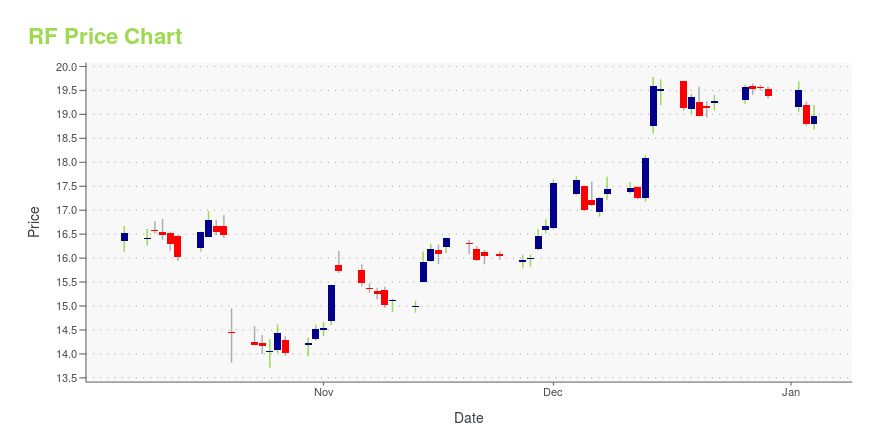

RF Stock Price Chart Interactive Chart >

Regions Financial Corp. (RF) Company Bio

Regions Financial Corporation is a bank holding company headquartered in the Regions Center in Birmingham, Alabama. The company provides retail banking and commercial banking, trust, stockbrokerage, and mortgage services. Its banking subsidiary, Regions Bank, operates 1,952 automated teller machines and 1,454 branches in 16 states in the Southern and Midwestern United States. (Source:Wikipedia)

Latest RF News From Around the Web

Below are the latest news stories about REGIONS FINANCIAL CORP that investors may wish to consider to help them evaluate RF as an investment opportunity.

Innovating To Lift Up CommunitiesRegions Community Development Corporation collaborated with internal partners to create technology enhancements and process improvements to better support mission-driven clients. NORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / Regions Bank By Candace ... |

How Regions Is Helping Strengthen Communities From the Ground UpNORTHAMPTON, MA / ACCESSWIRE / December 21, 2023 / Regions Bank: Affordable housing is crucial in a vibrant, growing community. But in some places, it's getting harder to find. By Jennifer Elmore The Bottom Line Affordable housing is crucial. But ... |

Service and Support: Regions Bank and the Regions Foundation Announce Tornado Response PlanCLARKSVILLE, TN / ACCESSWIRE / December 19, 2023 / Regions BankRegions Foundation funding to support community recovery; Regions Bank services designed to help people impacted by recent storms in Tennessee and Kentucky. By Jeremy King Regions Bank ... |

Regions Financial to Announce Fourth Quarter and Full-Year 2023 Financial Results on Jan. 19, 2024BIRMINGHAM, Ala., December 19, 2023--Regions Financial Corp. announced the company is scheduled to release its fourth quarter and full-year 2023 results on Friday, Jan. 19, 2024. |

Bank Stocks Cheer for Lower RatesBank stocks are enjoying the chatter about potential [interest-rate cuts](https://www.wsj.com/economy/central-banking/fed-holds-rates-steady-and-sees-cuts-next-year-4d554e9f) at the Fed. The KBW Nasdaq Bank Index of big lenders was recently up 5%, while the Regional Bank version of the index was up 4%. |

RF Price Returns

| 1-mo | 20.55% |

| 3-mo | 18.96% |

| 6-mo | 23.48% |

| 1-year | 21.73% |

| 3-year | 34.54% |

| 5-year | 76.27% |

| YTD | 22.01% |

| 2023 | -5.69% |

| 2022 | 2.33% |

| 2021 | 39.39% |

| 2020 | -1.61% |

| 2019 | 33.35% |

RF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RF

Want to do more research on Regions Financial Corp's stock and its price? Try the links below:Regions Financial Corp (RF) Stock Price | Nasdaq

Regions Financial Corp (RF) Stock Quote, History and News - Yahoo Finance

Regions Financial Corp (RF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...