RF Industries, Ltd. (RFIL): Price and Financial Metrics

RFIL Price/Volume Stats

| Current price | $4.23 | 52-week high | $4.65 |

| Prev. close | $4.12 | 52-week low | $2.51 |

| Day low | $4.06 | Volume | 3,319 |

| Day high | $4.23 | Avg. volume | 11,220 |

| 50-day MA | $3.55 | Dividend yield | N/A |

| 200-day MA | $3.12 | Market Cap | 44.40M |

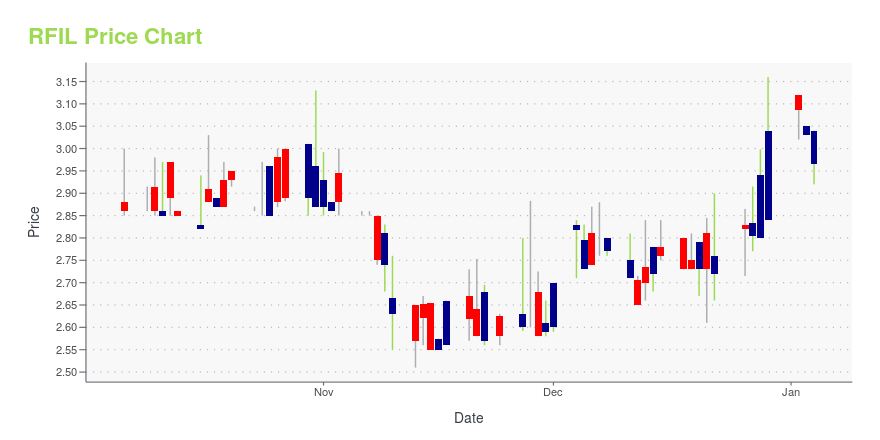

RFIL Stock Price Chart Interactive Chart >

RF Industries, Ltd. (RFIL) Company Bio

RF Industries, Ltd. designs, manufactures, and markets interconnect products and systems in the United States and internationally. The company's RF Connector and Cable Assembly division designs, manufactures, and distributes coaxial connectors and cable assemblies that are integrated with coaxial connectors. Its Cables Unlimited division manufactures and sells custom and standard cable assemblies, hybrid fiber optic power solution cables, adapters, and electromechanical wiring harnesses for communication, computer, LAN, automotive, and medical equipment. The company's Comnet Telecom Supply division manufactures and sells fiber optics cables, distinctive cabling technologies, and custom patch cord assemblies, as well as other data center products. Its Rel-Tech Electronics division designs and manufactures cable assemblies and wiring harnesses for blue chip industrial, oilfield, instrumentation, medical, and military customers. The company was formerly known as Celltronics, Inc. and changed its name to RF Industries, Ltd. in November 1990. RF Industries, Ltd. was founded in 1979 and is based in San Diego, California.

Latest RFIL News From Around the Web

Below are the latest news stories about R F INDUSTRIES LTD that investors may wish to consider to help them evaluate RFIL as an investment opportunity.

The Returns On Capital At RF Industries (NASDAQ:RFIL) Don't Inspire ConfidenceTo find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will... |

RF Industries, Ltd. (NASDAQ:RFIL) Q3 2023 Earnings Call TranscriptRF Industries, Ltd. (NASDAQ:RFIL) Q3 2023 Earnings Call Transcript September 14, 2023 RF Industries, Ltd. reports earnings inline with expectations. Reported EPS is $0.08 EPS, expectations were $0.08. Operator: Greetings. Welcome to the RF Industries Third Quarter Fiscal 2023 Financial Results Conference Call. [Operator Instructions] Please note, this conference is being recorded. I will now […] |

Q3 2023 RF Industries Ltd Earnings CallQ3 2023 RF Industries Ltd Earnings Call |

RF Industries, Ltd. (RFIL) Reports Q3 Loss, Misses Revenue EstimatesRF Industries, Ltd. (RFIL) delivered earnings and revenue surprises of -200% and 27.03%, respectively, for the quarter ended July 2023. Do the numbers hold clues to what lies ahead for the stock? |

RF Industries Announces Third Quarter Fiscal 2023 ResultsRF Industries, Ltd. (NASDAQ:RFIL),a national manufacturer and marketer of interconnect products and systems, today announced results for its third fiscal quarter ended July 31, 2023. |

RFIL Price Returns

| 1-mo | 23.68% |

| 3-mo | 43.88% |

| 6-mo | 36.01% |

| 1-year | 11.90% |

| 3-year | -54.61% |

| 5-year | -43.52% |

| YTD | 39.14% |

| 2023 | -40.86% |

| 2022 | -35.75% |

| 2021 | 62.93% |

| 2020 | -27.00% |

| 2019 | -5.85% |

Continue Researching RFIL

Here are a few links from around the web to help you further your research on R F Industries Ltd's stock as an investment opportunity:R F Industries Ltd (RFIL) Stock Price | Nasdaq

R F Industries Ltd (RFIL) Stock Quote, History and News - Yahoo Finance

R F Industries Ltd (RFIL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...