RH (RH): Price and Financial Metrics

RH Price/Volume Stats

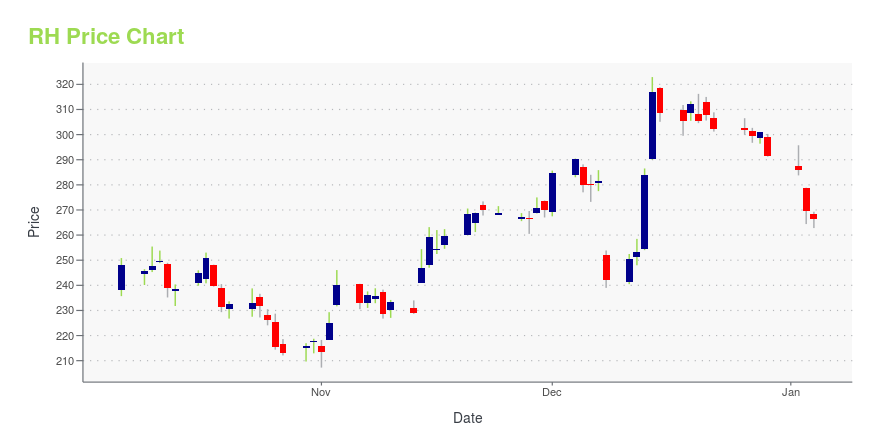

| Current price | $280.97 | 52-week high | $406.38 |

| Prev. close | $260.65 | 52-week low | $207.26 |

| Day low | $265.73 | Volume | 889,200 |

| Day high | $281.84 | Avg. volume | 725,752 |

| 50-day MA | $258.16 | Dividend yield | N/A |

| 200-day MA | $264.54 | Market Cap | 5.18B |

RH Stock Price Chart Interactive Chart >

RH (RH) Company Bio

RH (formerly Restoration Hardware) is an upscale American home-furnishings company headquartered in Corte Madera, California. The company sells its merchandise through its retail stores, catalog, and online. As of August 2018, the company operated a total of 70 galleries, 18 full-line design galleries, and 6 baby-and-child galleries. The company also has 36 outlet stores in the United States and Canada. (Source:Wikipedia)

Latest RH News From Around the Web

Below are the latest news stories about RH that investors may wish to consider to help them evaluate RH as an investment opportunity.

Director Keith Belling Sells 500 Shares of RHOn December 20, 2023, Keith Belling, a director at RH, executed a sale of 500 shares of the company. |

Amazon and RH have been highlighted as Zacks Bull and Bear of the DayAmazon and RH have been highlighted as Zacks Bull and Bear of the Day. |

Bear of the Day: RH (RH)RH (RH), once known as Restoration Hardware, posted a surprise quarterly loss on December 7 and provided downbeat guidance. |

RH's (NYSE:RH) 22% CAGR outpaced the company's earnings growth over the same five-year periodWhen you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose... |

3 Retail Stocks to Sell as Consumers Tighten Their BeltsSteer clear of these retail stocks as the companies are struggling with big problems that have weighed down their share prices. |

RH Price Returns

| 1-mo | 28.19% |

| 3-mo | 12.88% |

| 6-mo | 3.06% |

| 1-year | -26.29% |

| 3-year | -58.26% |

| 5-year | 114.84% |

| YTD | -3.61% |

| 2023 | 9.09% |

| 2022 | -50.15% |

| 2021 | 19.76% |

| 2020 | 109.61% |

| 2019 | 78.18% |

Continue Researching RH

Here are a few links from around the web to help you further your research on Rh's stock as an investment opportunity:Rh (RH) Stock Price | Nasdaq

Rh (RH) Stock Quote, History and News - Yahoo Finance

Rh (RH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...