RiceBran Technologies (RIBT): Price and Financial Metrics

RIBT Price/Volume Stats

| Current price | $0.14 | 52-week high | $0.99 |

| Prev. close | $0.12 | 52-week low | $0.06 |

| Day low | $0.12 | Volume | 22,700 |

| Day high | $0.14 | Avg. volume | 16,522 |

| 50-day MA | $0.13 | Dividend yield | N/A |

| 200-day MA | $0.20 | Market Cap | 1.40M |

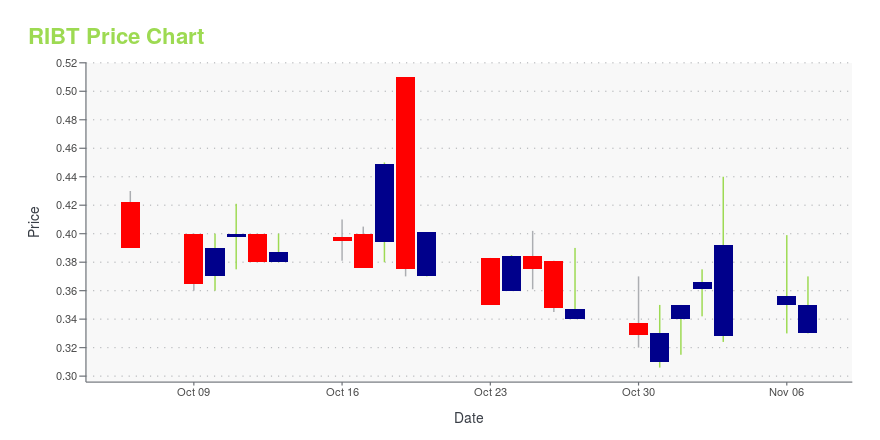

RIBT Stock Price Chart Interactive Chart >

RiceBran Technologies (RIBT) Company Bio

RiceBran Technologies researches and develops rice bran-based nutrients. The Company markets proprietary whole food dietary supplements derived from nutrient-dense stabilized rice bran.

Latest RIBT News From Around the Web

Below are the latest news stories about RICEBRAN TECHNOLOGIES that investors may wish to consider to help them evaluate RIBT as an investment opportunity.

Unmasking the Value Trap: A Comprehensive Analysis of RiceBran Technologies (RIBT)Is RiceBran Technologies a Hidden Gem or a Potential Value Trap? |

RiceBran Technologies Reports Second Quarter 2023 Results/ RiceBran Technologies (NASDAQ:RIBT) ("RiceBran" or the "Company"), an innovator in the development and manufacture of nutritional and functional ingredients derived from rice, barley and oats, today announced financial results for the second quarter ended June 30, 2023. |

RiceBran Technologies Adopts Tax Benefits Preservation Plan Designed to Protect the Availability of Its Tax Benefits/ RiceBran Technologies (NASDAQ:RIBT) ("RiceBran" or the "Company"), a global leader in the development and manufacture of nutritional and functional ingredients derived from rice and other small and ancient grains for human food, nutraceutical, pet care and equine feed applications, today announced that its Board of Directors (the "Board") has adopted a Tax Benefits Preservation Plan (the "Tax Plan"). |

RiceBran Technologies Sells SRB BusinessRiceBran Technologies (NASDAQ:RIBT) ("RiceBran" or the "Company"), a global leader in the development and manufacture of nutritional and functional ingredients derived from rice and other small and ancient grains for food, nutraceutical, pet care and equine feed applications, today announced that it has sold its stabilized rice bran ("SRB") business for total consideration of approximately $3.5 million, consisting of $1.8 million in cash and the |

20 Countries with Highest Rice Consumption Per CapitaIn this article, we will be covering the top 20 countries with highest rice consumption per capita. If you want to skip our detailed analysis of the rice industry and consumption trends, go directly to the Top 5 Countries with Highest Rice Consumption Per Capita. Rice is one of the most widely consumed staple foods in the world, […] |

RIBT Price Returns

| 1-mo | 21.74% |

| 3-mo | -12.50% |

| 6-mo | 7.69% |

| 1-year | -85.11% |

| 3-year | -98.47% |

| 5-year | -99.46% |

| YTD | -39.78% |

| 2023 | -68.79% |

| 2022 | -78.66% |

| 2021 | -42.79% |

| 2020 | -58.50% |

| 2019 | -51.00% |

Continue Researching RIBT

Want to do more research on RiceBran Technologies's stock and its price? Try the links below:RiceBran Technologies (RIBT) Stock Price | Nasdaq

RiceBran Technologies (RIBT) Stock Quote, History and News - Yahoo Finance

RiceBran Technologies (RIBT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...