Rocket Cos. Inc. (RKT): Price and Financial Metrics

RKT Price/Volume Stats

| Current price | $12.04 | 52-week high | $21.38 |

| Prev. close | $12.25 | 52-week low | $10.06 |

| Day low | $12.04 | Volume | 6,654,800 |

| Day high | $12.64 | Avg. volume | 8,092,492 |

| 50-day MA | $13.49 | Dividend yield | N/A |

| 200-day MA | $15.03 | Market Cap | 24.03B |

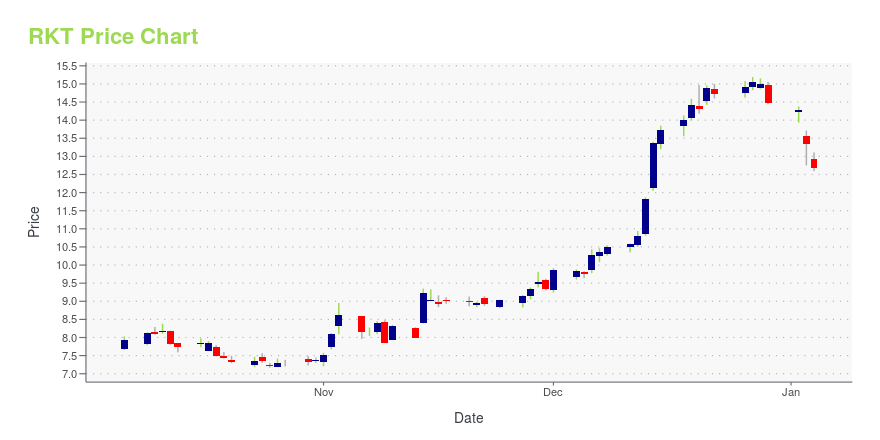

RKT Stock Price Chart Interactive Chart >

Rocket Cos. Inc. (RKT) Company Bio

Rocket Mortgage, LLC (formerly known as Quicken Loans LLC) is a mortgage loan provider. It is headquartered in the One Campus Martius building in the financial district of Downtown Detroit, Michigan. In January 2018, the company became the largest overall retail lender in the U.S. (it is also the largest online retail mortgage lender). Unlike other large mortgage lenders that depend on deposits, Rocket Mortgage relies on wholesale funding to make its loans and uses online applications rather than a branch system. Amrock and One Reverse Mortgage are also part of the Rocket Mortgage Family of Companies. The company closed more than $400 billion of mortgage volume across all 50 states from 2013 through 2017. (Source:Wikipedia)

RKT Price Returns

| 1-mo | -14.67% |

| 3-mo | 0.58% |

| 6-mo | -26.63% |

| 1-year | 3.08% |

| 3-year | 38.87% |

| 5-year | N/A |

| YTD | 6.93% |

| 2024 | -22.24% |

| 2023 | 106.86% |

| 2022 | -50.00% |

| 2021 | -30.76% |

| 2020 | N/A |

Loading social stream, please wait...