Rocket Cos. Inc. (RKT): Price and Financial Metrics

RKT Price/Volume Stats

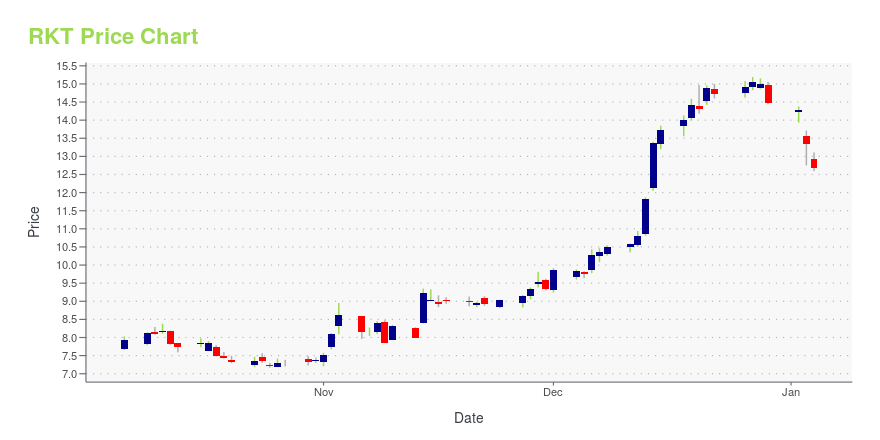

| Current price | $15.91 | 52-week high | $16.00 |

| Prev. close | $15.22 | 52-week low | $7.17 |

| Day low | $15.30 | Volume | 3,153,671 |

| Day high | $16.00 | Avg. volume | 2,505,614 |

| 50-day MA | $14.26 | Dividend yield | N/A |

| 200-day MA | $12.19 | Market Cap | 31.63B |

RKT Stock Price Chart Interactive Chart >

Rocket Cos. Inc. (RKT) Company Bio

Rocket Mortgage, LLC (formerly known as Quicken Loans LLC) is a mortgage loan provider. It is headquartered in the One Campus Martius building in the financial district of Downtown Detroit, Michigan. In January 2018, the company became the largest overall retail lender in the U.S. (it is also the largest online retail mortgage lender). Unlike other large mortgage lenders that depend on deposits, Rocket Mortgage relies on wholesale funding to make its loans and uses online applications rather than a branch system. Amrock and One Reverse Mortgage are also part of the Rocket Mortgage Family of Companies. The company closed more than $400 billion of mortgage volume across all 50 states from 2013 through 2017. (Source:Wikipedia)

Latest RKT News From Around the Web

Below are the latest news stories about ROCKET COMPANIES INC that investors may wish to consider to help them evaluate RKT as an investment opportunity.

Mortgage Company Stocks Have More Than Doubled This YearThe Federal Reserve's new tune on interest rates has been good for mortgage company stocks. Shares in some of those firms have more than doubled this year, including a big run-up this month after the central bank [signaled it is done lifting rates](https://www. |

15 Prominent NYSE Stocks That Hit 52-Week Highs This WeekIn this article, we will take a look at the 15 prominent NYSE stocks that hit 52-week highs this week. To skip our analysis of the recent trends, and market activity, you can go directly to see the 5 Prominent NYSE Stocks That Hit 52-Week Highs This Week. The Wall Street ended another week in […] |

Rocket Homes Launches First AI-Driven Apple CarPlay Feature to Fuel HomeownershipRocket Homes, a tech-based real estate service provider and part of Rocket Companies (NYSE: RKT), today announced its iOS app is now available on car, truck and SUV infotainment screens through Apple CarPlay – turning the everyday commute into an exciting and natural part of the homebuying journey. |

Agree Realty Announces Appointment of Linglong He to Board of DirectorsAgree Realty Corporation (NYSE: ADC) (the "Company") today announced that Linglong He will join the Company's Board of Directors (the "Board"), effective January 1, 2024. |

Fintech Rocket Cos. Stock Scores Relative Price Strength UpgradeOn Thursday, Rocket Cos. stock earned a positive adjustment to its Relative Strength (RS) Rating, from 79 to 85. The Detroit-based fintech firm provides mortgage lending, title, and settlement services. Is Rocket Cos. Stock A Buy? |

RKT Price Returns

| 1-mo | 14.79% |

| 3-mo | 28.83% |

| 6-mo | 29.98% |

| 1-year | 52.83% |

| 3-year | -7.77% |

| 5-year | N/A |

| YTD | 9.88% |

| 2023 | 106.86% |

| 2022 | -50.00% |

| 2021 | -30.76% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...