Regional Management Corp. (RM): Price and Financial Metrics

RM Price/Volume Stats

| Current price | $31.74 | 52-week high | $33.99 |

| Prev. close | $31.83 | 52-week low | $20.50 |

| Day low | $31.37 | Volume | 19,930 |

| Day high | $32.53 | Avg. volume | 28,096 |

| 50-day MA | $28.34 | Dividend yield | 3.87% |

| 200-day MA | $25.49 | Market Cap | 314.10M |

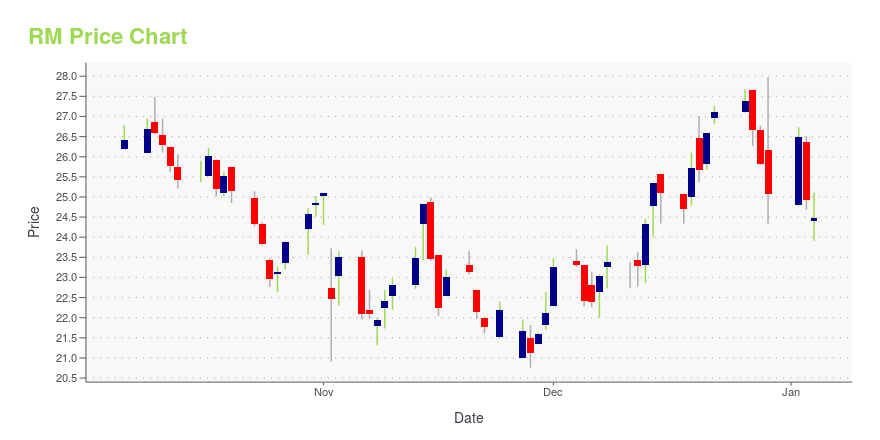

RM Stock Price Chart Interactive Chart >

Regional Management Corp. (RM) Company Bio

Regional Management Corporation is a diversified specialty consumer finance company providing a broad array of loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies and other traditional lenders. The company was founded in 1987 and is based in Greenville, South Carolina.

Latest RM News From Around the Web

Below are the latest news stories about REGIONAL MANAGEMENT CORP that investors may wish to consider to help them evaluate RM as an investment opportunity.

Investors in Regional Management (NYSE:RM) have unfortunately lost 10% over the last yearRegional Management Corp. ( NYSE:RM ) shareholders should be happy to see the share price up 13% in the last month. But... |

New Strong Sell Stocks for November 28thAMR, PNGAY and RM have been added to the Zacks Rank #5 (Strong Sell) List on November 28, 2023. |

Regional Management's (NYSE:RM) Dividend Will Be $0.30Regional Management Corp. ( NYSE:RM ) has announced that it will pay a dividend of $0.30 per share on the 13th of... |

Regional Management (NYSE:RM) Could Be A Buy For Its Upcoming DividendRegional Management Corp. ( NYSE:RM ) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one... |

Regional Management Corp. Mourns Passing of Board Member Philip BancroftGREENVILLE, S.C., November 10, 2023--Regional Management Corp. (NYSE: RM), a diversified consumer finance company, issued a statement today announcing the loss of board member, Philip Bancroft, who unexpectedly passed away earlier this month. |

RM Price Returns

| 1-mo | 20.14% |

| 3-mo | 21.41% |

| 6-mo | 22.64% |

| 1-year | 1.34% |

| 3-year | -31.47% |

| 5-year | 46.54% |

| YTD | 29.59% |

| 2023 | -6.63% |

| 2022 | -49.62% |

| 2021 | 96.32% |

| 2020 | 0.26% |

| 2019 | 24.86% |

RM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RM

Want to do more research on Regional Management Corp's stock and its price? Try the links below:Regional Management Corp (RM) Stock Price | Nasdaq

Regional Management Corp (RM) Stock Quote, History and News - Yahoo Finance

Regional Management Corp (RM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...