Rockwell Medical, Inc. (RMTI): Price and Financial Metrics

RMTI Price/Volume Stats

| Current price | $1.89 | 52-week high | $3.72 |

| Prev. close | $1.85 | 52-week low | $1.16 |

| Day low | $1.82 | Volume | 82,900 |

| Day high | $1.97 | Avg. volume | 192,874 |

| 50-day MA | $1.85 | Dividend yield | N/A |

| 200-day MA | $1.69 | Market Cap | 57.30M |

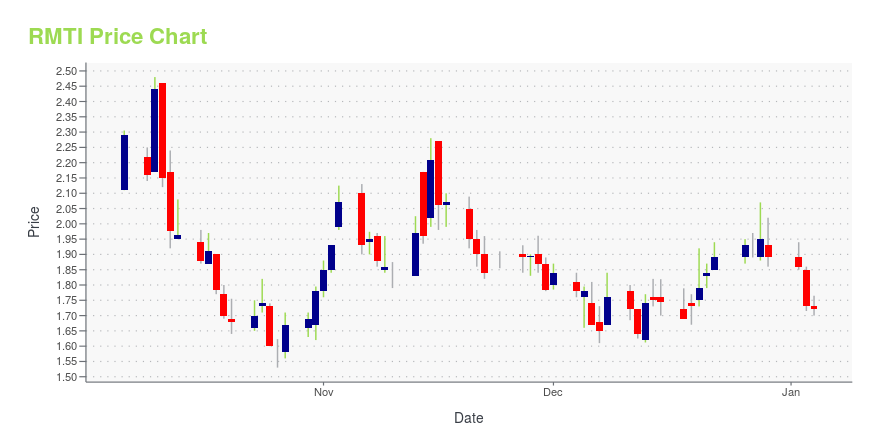

RMTI Stock Price Chart Interactive Chart >

Rockwell Medical, Inc. (RMTI) Company Bio

Rockwell Medical is a biopharmaceutical company targeting end-stage renal disease and chronic kidney disease with products and services for the treatment of iron replacement, secondary hyperparathyroidism and hemodialysis. The company was founded in 1995 and is based in Wixom, Michigan.

Latest RMTI News From Around the Web

Below are the latest news stories about ROCKWELL MEDICAL INC that investors may wish to consider to help them evaluate RMTI as an investment opportunity.

Rockwell Medical, Inc. (NASDAQ:RMTI): Are Analysts Optimistic?We feel now is a pretty good time to analyse Rockwell Medical, Inc.'s ( NASDAQ:RMTI ) business as it appears the... |

Rockwell Medical, Inc. (NASDAQ:RMTI) Q3 2023 Earnings Call TranscriptRockwell Medical, Inc. (NASDAQ:RMTI) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good morning, and welcome to Rockwell Medical’s Third Quarter 2023 Results Conference Call and Webcast. Please note this event is being recorded. At this time, I would like to turn the conference call over to Heather Hunter, Senior Vice President, Chief Corporate […] |

Q3 2023 Rockwell Medical Inc Earnings CallQ3 2023 Rockwell Medical Inc Earnings Call |

Rockwell Medical (RMTI) Reports Q3 Loss, Tops Revenue EstimatesRockwell Medical (RMTI) delivered earnings and revenue surprises of 41.67% and 0.43%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Rockwell Medical Announces Third Quarter 2023 ResultsWIXOM, Mich., November 14, 2023--Rockwell Medical, Inc. (the "Company") (Nasdaq: RMTI), a healthcare company that develops, manufactures, commercializes, and distributes a portfolio of hemodialysis products to dialysis providers worldwide, today announced financial and operational results for the three months ended September 30, 2023. |

RMTI Price Returns

| 1-mo | 8.62% |

| 3-mo | 29.90% |

| 6-mo | 33.10% |

| 1-year | -43.58% |

| 3-year | -76.14% |

| 5-year | -94.53% |

| YTD | 0.00% |

| 2023 | 86.21% |

| 2022 | -77.49% |

| 2021 | -59.41% |

| 2020 | -58.61% |

| 2019 | 7.96% |

Continue Researching RMTI

Want to do more research on Rockwell Medical Inc's stock and its price? Try the links below:Rockwell Medical Inc (RMTI) Stock Price | Nasdaq

Rockwell Medical Inc (RMTI) Stock Quote, History and News - Yahoo Finance

Rockwell Medical Inc (RMTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...