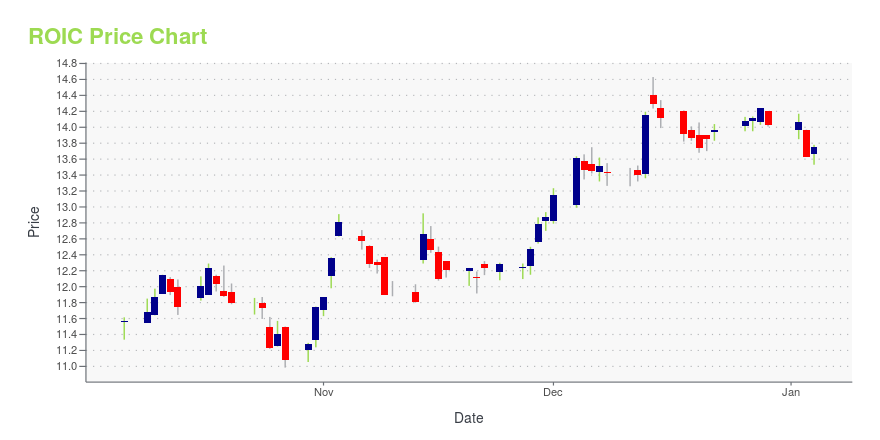

Retail Opportunity Investments Corp. (ROIC): Price and Financial Metrics

ROIC Price/Volume Stats

| Current price | $12.80 | 52-week high | $15.16 |

| Prev. close | $12.62 | 52-week low | $10.98 |

| Day low | $12.60 | Volume | 1,251,852 |

| Day high | $12.88 | Avg. volume | 1,055,470 |

| 50-day MA | $12.59 | Dividend yield | 4.45% |

| 200-day MA | $12.80 | Market Cap | 1.63B |

ROIC Stock Price Chart Interactive Chart >

Retail Opportunity Investments Corp. (ROIC) Company Bio

Retail Opportunity Investments Corporation engages in the acquisition, ownership, and management of necessity-based community and neighborhood shopping centers in the eastern and western regions of the United States. The company was founded in 2009 and is based in San Diego, California.

Latest ROIC News From Around the Web

Below are the latest news stories about RETAIL OPPORTUNITY INVESTMENTS CORP that investors may wish to consider to help them evaluate ROIC as an investment opportunity.

Retail Opportunity Investments Corp. (NASDAQ:ROIC) Q3 2023 Earnings Call TranscriptRetail Opportunity Investments Corp. (NASDAQ:ROIC) Q3 2023 Earnings Call Transcript October 25, 2023 Retail Opportunity Investments Corp. misses on earnings expectations. Reported EPS is $0.06329 EPS, expectations were $0.27. Operator: Welcome to the Retail Opportunity Investments Third Quarter 2023 Conference Call. Participants are currently in a listen-only mode. Following the company’s prepared remarks, the call […] |

Q3 2023 Retail Opportunity Investments Corp Earnings CallQ3 2023 Retail Opportunity Investments Corp Earnings Call |

Retail Opportunity Investments Corp (ROIC) Reports Strong Q3 2023 ResultsROIC's Q3 2023 Earnings Highlight Solid Performance and Leasing Momentum |

Retail Opportunity Investments (ROIC) Matches Q3 FFO EstimatesRetail Opportunity Investments (ROIC) delivered FFO and revenue surprises of 0% and 0.49%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Retail Opportunity Investments Corp. Reports 2023 Third Quarter ResultsSAN DIEGO, Oct. 24, 2023 (GLOBE NEWSWIRE) -- Retail Opportunity Investments Corp. (NASDAQ:ROIC) announced today financial and operating results for the three and nine months ended September 30, 2023. HIGHLIGHTS $8.4 million of net income attributable to common stockholders ($0.07 per diluted share)$36.0 million in Funds From Operations (FFO)(1) ($0.27 per diluted share)FFO per diluted share guidance for 2023 narrowed ($1.05 - $1.07 per diluted share)8.2% increase in same-center cash net operatin |

ROIC Price Returns

| 1-mo | 4.75% |

| 3-mo | 5.76% |

| 6-mo | -6.24% |

| 1-year | -7.70% |

| 3-year | -18.45% |

| 5-year | -15.59% |

| YTD | -6.57% |

| 2023 | -2.43% |

| 2022 | -20.65% |

| 2021 | 50.64% |

| 2020 | -22.90% |

| 2019 | 16.36% |

ROIC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ROIC

Want to see what other sources are saying about Retail Opportunity Investments Corp's financials and stock price? Try the links below:Retail Opportunity Investments Corp (ROIC) Stock Price | Nasdaq

Retail Opportunity Investments Corp (ROIC) Stock Quote, History and News - Yahoo Finance

Retail Opportunity Investments Corp (ROIC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...