Root Inc. Cl A (ROOT): Price and Financial Metrics

ROOT Price/Volume Stats

| Current price | $67.85 | 52-week high | $86.57 |

| Prev. close | $66.28 | 52-week low | $7.22 |

| Day low | $65.30 | Volume | 190,600 |

| Day high | $69.78 | Avg. volume | 554,720 |

| 50-day MA | $57.48 | Dividend yield | N/A |

| 200-day MA | $34.68 | Market Cap | 1.01B |

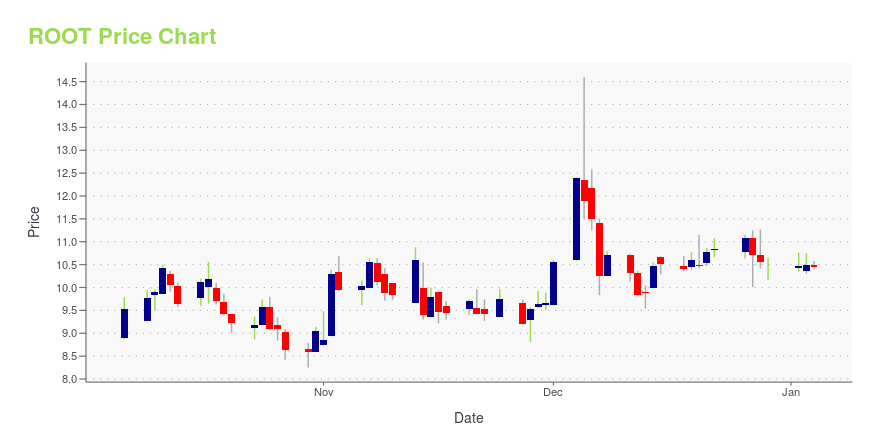

ROOT Stock Price Chart Interactive Chart >

Root Inc. Cl A (ROOT) Company Bio

Root, Inc. is the parent company of Root Insurance Company. Root is a technology company revolutionizing personal insurance with a pricing model based upon fairness and a modern customer experience. Root’s modern, mobile-first customer experience is designed to make insurance simple.

Latest ROOT News From Around the Web

Below are the latest news stories about ROOT INC that investors may wish to consider to help them evaluate ROOT as an investment opportunity.

Institutional investors in Root, Inc. (NASDAQ:ROOT) lost 14% last week but have reaped the benefits of longer-term growthKey Insights Significantly high institutional ownership implies Root's stock price is sensitive to their trading... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to start the final day of trading this week with a breakdown of the biggest pre-market stock movers for Friday! |

Insider Sell Alert: Chief Administrative Officer Jonathan Allison Sells 8,000 Shares of Root ...In a recent transaction on December 5, 2023, Jonathan Allison, the Chief Administrative Officer of Root Inc (NASDAQ:ROOT), sold 8,000 shares of the company's stock. |

Chief Technology Officer of Root Picks Up 12% More StockPotential Root, Inc. ( NASDAQ:ROOT ) shareholders may wish to note that the Chief Technology Officer, Matt... |

Root, Inc. (NASDAQ:ROOT) Q3 2023 Earnings Call TranscriptRoot, Inc. (NASDAQ:ROOT) Q3 2023 Earnings Call Transcript November 2, 2023 Operator: Good morning. My name is Chris, and I will be your conference operator today. At this time, I’d like to welcome everyone to the Root Inc. Q3 2023 Earnings Conference Call. [Operator Instructions] Thank you. Matt LaMalva, head of Investor Relations, you may […] |

ROOT Price Returns

| 1-mo | 44.67% |

| 3-mo | 5.36% |

| 6-mo | 674.54% |

| 1-year | 601.65% |

| 3-year | -49.34% |

| 5-year | N/A |

| YTD | 547.42% |

| 2023 | 133.41% |

| 2022 | -91.95% |

| 2021 | -80.27% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...