Rotor Acquisition Corp. (ROT): Price and Financial Metrics

ROT Price/Volume Stats

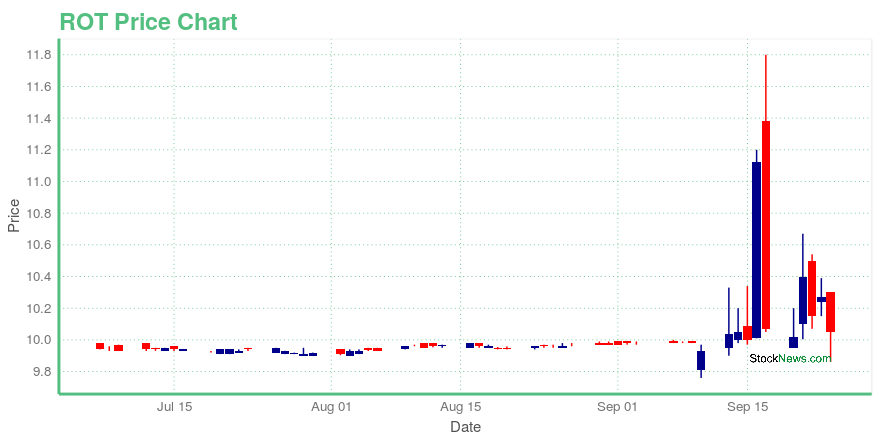

| Current price | $10.05 | 52-week high | $11.80 |

| Prev. close | $10.27 | 52-week low | $9.61 |

| Day low | $9.86 | Volume | 328,100 |

| Day high | $10.30 | Avg. volume | 215,245 |

| 50-day MA | $10.00 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 277.38M |

ROT Stock Price Chart Interactive Chart >

Rotor Acquisition Corp. (ROT) Company Bio

Rotor Acquisition Corp. operates as a blank check company. The Company aims to acquire one and more businesses and assets, via a merger, capital stock exchange, asset acquisition, stock purchase, and reorganization.

ROT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2024 | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...