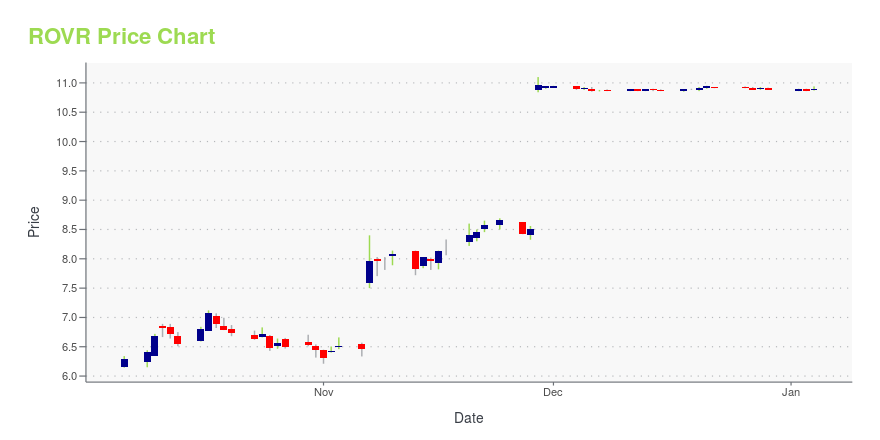

Rover Group, Inc. (ROVR): Price and Financial Metrics

ROVR Price/Volume Stats

| Current price | $10.99 | 52-week high | $11.10 |

| Prev. close | $10.99 | 52-week low | $3.75 |

| Day low | $10.99 | Volume | 2,163,200 |

| Day high | $11.00 | Avg. volume | 2,104,847 |

| 50-day MA | $10.93 | Dividend yield | N/A |

| 200-day MA | $7.48 | Market Cap | 1.97B |

ROVR Stock Price Chart Interactive Chart >

Rover Group, Inc. (ROVR) Company Bio

As of July 30, 2021, Nebula Caravel Acquisition Corp. was acquired by A Place for Rover, Inc., in a reverse merger transaction. Nebula Caravel Acquisition Corp. does not have significant operations. It intends to effect a merger, share exchange, asset acquisition, share purchase, reorganization, or related business combination with one or more businesses or entities. The company was incorporated in 2020 and is based in San Francisco, California.

Latest ROVR News From Around the Web

Below are the latest news stories about ROVER GROUP INC that investors may wish to consider to help them evaluate ROVR as an investment opportunity.

3 Penny Stocks You’ll Regret Not Buying Soon: December EditionConsider the pros and cons of buying these penny stocks, which can deliver risk-adjusted returns to investors' portfolios. |

Insider Sell Alert: CFO Charles Wickers Sells 19,217 Shares of Rover Group Inc (ROVR)In a notable insider transaction, Charles Wickers, the Chief Financial Officer of Rover Group Inc (NASDAQ:ROVR), sold 19,217 shares of the company on December 11, 2023. |

Insider Sell Alert: President & COO Brenton Turner Unloads 60,000 Shares of Rover Group Inc ...In the world of stock market investments, insider trading activities often serve as a barometer for a company's health and future prospects. |

Insider Sell Alert: President & COO Brenton Turner Unloads 90,000 Shares of Rover Group Inc ...In a notable insider transaction, Brenton Turner, the President & Chief Operating Officer of Rover Group Inc (NASDAQ:ROVR), sold 90,000 shares of the company on December 1, 2023. |

ROVR Stock Alert: Blackstone Just Bought Rover for $2.3 BillionRover (ROVR) stock is up nearly 30% today on news that the pet care platform will be acquired by Blackstone for $2.3 billion. |

ROVR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 0.37% |

| 1-year | 103.52% |

| 3-year | 10.90% |

| 5-year | N/A |

| YTD | 1.01% |

| 2023 | 196.46% |

| 2022 | -62.36% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...