ReWalk Robotics Ltd. - Ordinary Shares (RWLK): Price and Financial Metrics

RWLK Price/Volume Stats

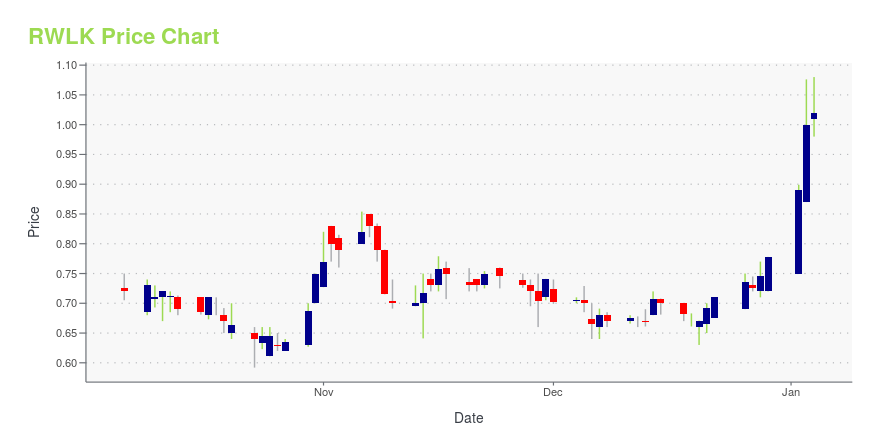

| Current price | $1.05 | 52-week high | $1.30 |

| Prev. close | $0.99 | 52-week low | $0.56 |

| Day low | $0.98 | Volume | 303,600 |

| Day high | $1.10 | Avg. volume | 541,468 |

| 50-day MA | $0.83 | Dividend yield | N/A |

| 200-day MA | $0.72 | Market Cap | 63.03M |

RWLK Stock Price Chart Interactive Chart >

ReWalk Robotics Ltd. - Ordinary Shares (RWLK) Company Bio

ReWalk Robotics Ltd., a medical device company, designs, develops, and commercializes exoskeletons for wheelchair-bound individuals. The company was founded in 2001 and is based in Yokneam Ilit, Israel.

Latest RWLK News From Around the Web

Below are the latest news stories about REWALK ROBOTICS LTD that investors may wish to consider to help them evaluate RWLK as an investment opportunity.

We Think ReWalk Robotics (NASDAQ:RWLK) Needs To Drive Business Growth CarefullyThere's no doubt that money can be made by owning shares of unprofitable businesses. For example, although... |

ReWalk Robotics Presents on Personal Exoskeleton Pricing at Medicare Public MeetingReWalk supports “gap-filling” pricing method proposed by CMS with use of up-to-date pricing information.MARLBOROUGH, Mass. and BERLIN and YOKNEAM ILLIT, Israel, Nov. 30, 2023 (GLOBE NEWSWIRE) -- ReWalk Robotics, Ltd. (Nasdaq: RWLK) ("ReWalk" or the "Company"), a leading provider of innovative technologies that enable mobility and wellness in rehabilitation and daily life for individuals with neurological conditions, presented at the Healthcare Common Procedure Coding System (“HCPCS”) public meet |

Penny Stock Powerhouses: 7 Picks Poised for Explosive GrowthUndeniably, the concept of growth penny stocks represent one of the hottest topics on Wall Street. |

ReWalk Robotics Demonstrates AI Autonomous Decision Making in Next Generation Exoskeleton PrototypeR&D Grant from the Israeli Technology Innovation Consortium Enabled the Successful Demonstration of a Working Prototype MARLBOROUGH, Mass. and BERLIN and YOKNEAM ILLIT, Israel, Nov. 28, 2023 (GLOBE NEWSWIRE) -- ReWalk Robotics, Ltd. (Nasdaq: RWLK) ("ReWalk" or the "Company"), a leading provider of innovative technologies that enable mobility and wellness in rehabilitation and daily life for individuals with neurological conditions, announced the successful demonstration of a proof-of-concept nex |

7 Cheap Stocks to Buy Now if You Have $100 to Spend: November EditionUncover these top cheap stocks to buy for substantial portfolio expansion ahead of a likely bull run in 2024. |

RWLK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 6.06% |

| 1-year | 48.03% |

| 3-year | -29.53% |

| 5-year | -72.51% |

| YTD | 35.01% |

| 2023 | 2.32% |

| 2022 | -38.20% |

| 2021 | -6.82% |

| 2020 | -38.89% |

| 2019 | -50.34% |

Continue Researching RWLK

Here are a few links from around the web to help you further your research on ReWalk Robotics Ltd's stock as an investment opportunity:ReWalk Robotics Ltd (RWLK) Stock Price | Nasdaq

ReWalk Robotics Ltd (RWLK) Stock Quote, History and News - Yahoo Finance

ReWalk Robotics Ltd (RWLK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...