Recursion Pharmaceuticals Inc. (RXRX): Price and Financial Metrics

RXRX Price/Volume Stats

| Current price | $8.35 | 52-week high | $15.74 |

| Prev. close | $8.05 | 52-week low | $4.97 |

| Day low | $8.14 | Volume | 2,954,303 |

| Day high | $8.49 | Avg. volume | 6,088,132 |

| 50-day MA | $8.56 | Dividend yield | N/A |

| 200-day MA | $8.92 | Market Cap | 1.98B |

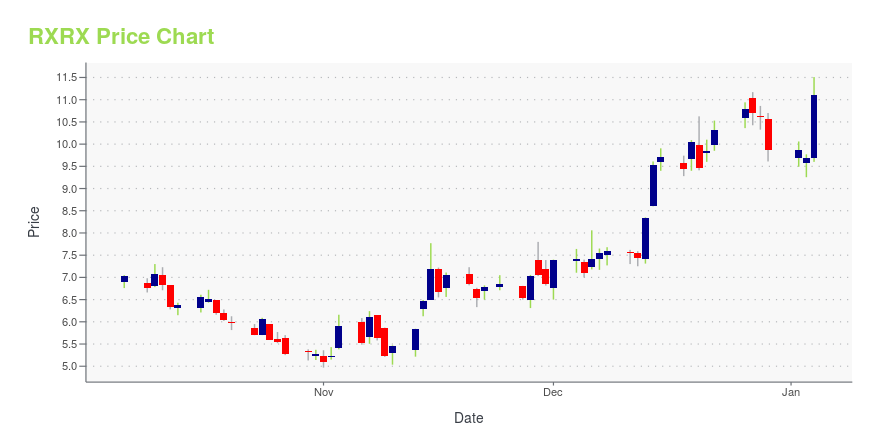

RXRX Stock Price Chart Interactive Chart >

Recursion Pharmaceuticals Inc. (RXRX) Company Bio

Recursion Pharmaceuticals, Inc. is a clinical-stage biotechnology company that combines automation, artificial intelligence, machine learning, and in vivo validation capabilities to discover novel medicines. Its Recursion operating system enables advanced machine learning approaches to reveal drug candidates, mechanisms of action, novel chemistry, and potential toxicity, with the eventual goal of decoding biology and advancing new therapeutics that radically improve people’s lives. The company was founded by Blake Borgeson, Christopher C. Gibson, and Dean Y. Li on November 4, 2013 and is headquartered in Salt Lake City, UT.

Latest RXRX News From Around the Web

Below are the latest news stories about RECURSION PHARMACEUTICALS INC that investors may wish to consider to help them evaluate RXRX as an investment opportunity.

40 Cities with the Highest Life Expectancy in the USIn this article, we look at 40 Cities With The Highest Life Expectancy In The US. You can skip our detailed analysis on companies that are working on longevity enhancement and improved health facilities by heading over directly to the 10 Cities With The Highest Life Expectancy In The US. Life expectancy of a newborn […] |

Recursion and Enamine to Generate and Design Enriched Compound Libraries for Global Drug Discovery IndustryScreening libraries will leverage Recursion's MatchMaker tool to identify compounds across Enamine REAL Space predicted to bind to high-value targets.KYIV, Ukraine and SALT LAKE CITY, Dec. 20, 2023 (GLOBE NEWSWIRE) -- Recursion (NASDAQ: RXRX), a leading clinical stage TechBio company decoding biology to industrialize drug discovery, today announced its partnership with Enamine, a world-renowned provider of novel molecules and contract research services, to generate enriched screening libraries w |

3 Genomics Stocks to Unlock the Future of MedicineGenomics stocks stand to surge in 2024 after the FDA approved the nation's first gene-editing therapeutic for clinical use. |

2 Cathie Wood Stocks That Might Be Smart Buys Right NowThese two biotech stocks hold enormous potential. |

AI Meets Biotech: 3 Top Stocks Transforming Medical ScienceThe AI revolution is bringing big gains to biotechnology, including drugs, antibodies, and synthetic biology. |

RXRX Price Returns

| 1-mo | -4.68% |

| 3-mo | 2.83% |

| 6-mo | -14.62% |

| 1-year | -35.32% |

| 3-year | -72.82% |

| 5-year | N/A |

| YTD | -15.31% |

| 2023 | 27.89% |

| 2022 | -54.99% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...