Ryanair Holdings PLC ADR (RYAAY): Price and Financial Metrics

RYAAY Price/Volume Stats

| Current price | $102.42 | 52-week high | $150.73 |

| Prev. close | $97.74 | 52-week low | $87.18 |

| Day low | $100.64 | Volume | 2,814,300 |

| Day high | $104.68 | Avg. volume | 620,940 |

| 50-day MA | $117.59 | Dividend yield | 0.97% |

| 200-day MA | $124.77 | Market Cap | 23.12B |

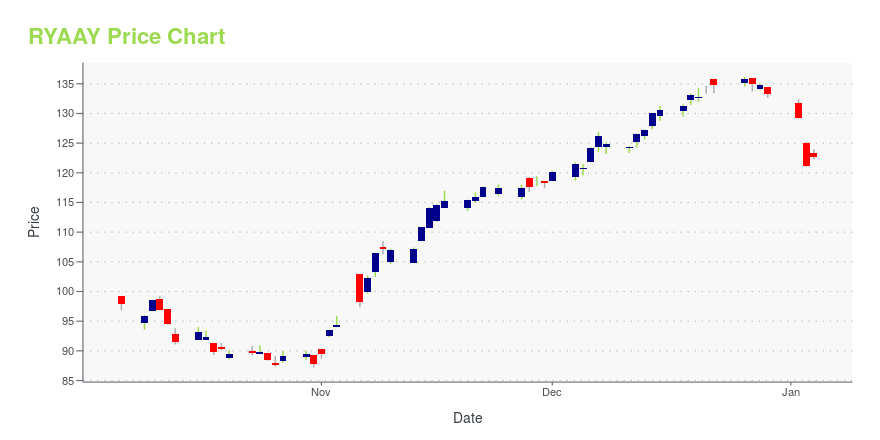

RYAAY Stock Price Chart Interactive Chart >

Ryanair Holdings PLC ADR (RYAAY) Company Bio

Ryanair DAC is an Irish ultra low-cost carrier founded in 1984. It is headquartered in Swords, Dublin, Ireland and has its primary operational bases at Dublin and London Stansted airports. It forms the largest part of the Ryanair Holdings family of airlines and has Ryanair UK, Buzz, Lauda Europe, and Malta Air as sister airlines. It is Ireland's biggest airline and in 2016 became Europe's largest budget airline by scheduled passengers flown, carrying more international passengers than any other airline. (Source:Wikipedia)

Latest RYAAY News From Around the Web

Below are the latest news stories about RYANAIR HOLDINGS PLC that investors may wish to consider to help them evaluate RYAAY as an investment opportunity.

Ryanair’s CEO says consumers will always choose budget flights over environmental fears, as aviation has been wrongly made the ‘poster child’ for climate changeRyanair’s Michael O’Leary sees sustainable aviation fuel as a “wheeze” that’s not easy to scale up given airlines’ fuel demand. |

Ryanair (RYAAY) Hits 52-Week High: What's Driving the Stock?Ryanair (RYAAY) benefits from the continued recovery in air-travel demand. |

EU court annuls approval of French pandemic aid to Air France and Air France-KLMLow-cost airlines Ryanair and Malta Air won a court case Wednesday against the European Union's decision to approve billions of euros in state aid by the French government to Air France and holding company Air France-KLM during the COVID-19 pandemic. Ryanair has filed several court challenges against measures introduced by EU countries to help some airlines weather the fallout of coronavirus restrictions. The Irish airline welcomed the decision and urged the European Commission “to order France to immediately recover this multi-billion euro illegal state aid package." |

Airlines Post Impressive November Traffic Numbers: An AnalysisCopa Holdings (CPA), AZUL and Ryanair Holdings (RYAAY) report impressive traffic numbers for November 2023. |

Factbox-Greenwashing cases against airlines in Europe, USAirlines around the world are facing scrutiny from advertising and consumer agencies, regulators, and courts over allegedly making misleading claims about their sustainability efforts, sometimes dubbed "greenwashing". Lufthansa, Etihad and Air France-KLM all faced a ban on some of their online advertisements by Britain's Advertising Standards Authority (ASA) in December over accusations they gave a misleading impression of their environmental impact. |

RYAAY Price Returns

| 1-mo | -12.21% |

| 3-mo | -26.80% |

| 6-mo | -23.30% |

| 1-year | 2.53% |

| 3-year | -7.00% |

| 5-year | 61.43% |

| YTD | -22.62% |

| 2023 | 78.38% |

| 2022 | -26.94% |

| 2021 | -6.96% |

| 2020 | 25.53% |

| 2019 | 22.81% |

RYAAY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RYAAY

Want to do more research on Ryanair Holdings Plc's stock and its price? Try the links below:Ryanair Holdings Plc (RYAAY) Stock Price | Nasdaq

Ryanair Holdings Plc (RYAAY) Stock Quote, History and News - Yahoo Finance

Ryanair Holdings Plc (RYAAY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...