Rhythm Pharmaceuticals, Inc. (RYTM): Price and Financial Metrics

RYTM Price/Volume Stats

| Current price | $49.05 | 52-week high | $53.92 |

| Prev. close | $49.61 | 52-week low | $17.34 |

| Day low | $49.05 | Volume | 295,204 |

| Day high | $50.74 | Avg. volume | 594,359 |

| 50-day MA | $42.59 | Dividend yield | N/A |

| 200-day MA | $39.69 | Market Cap | 2.99B |

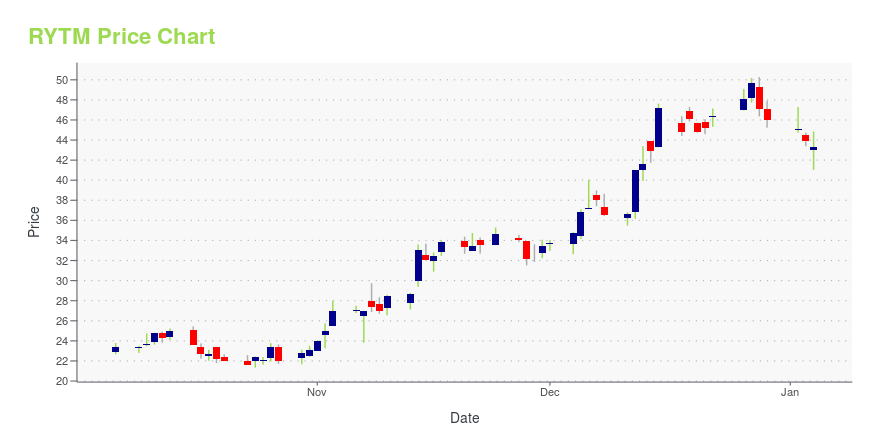

RYTM Stock Price Chart Interactive Chart >

Rhythm Pharmaceuticals, Inc. (RYTM) Company Bio

Rhythm Pharmaceuticals, Inc. develops and commercializes peptide therapeutics for the treatment of rare genetic disorders of obesity in the United States. Its lead product candidate is Setmelanotide, a melanocortin-4 receptor agonist that is in Phase III clinical trials for treating POMC deficiency obesity and leptin receptor deficiency obesity; and Phase II clinical trials for treating Bardet-Biedl syndrome, Alström syndrome, POMC heterozygous deficiency obesity, and POMC epigenetic disorders. The company was founded in 2008 and is based in Boston, Massachusetts.

Latest RYTM News From Around the Web

Below are the latest news stories about RHYTHM PHARMACEUTICALS INC that investors may wish to consider to help them evaluate RYTM as an investment opportunity.

Rhythm Pharmaceuticals Announces New Employment Inducement GrantsBOSTON, Dec. 15, 2023 (GLOBE NEWSWIRE) -- Rhythm Pharmaceuticals, Inc. (Nasdaq: RYTM), a commercial-stage biopharmaceutical company focused on transforming the lives of patients and their families living with hyperphagia and severe obesity caused by rare melanocortin-4 receptor (MC4R) pathway diseases, today announced that on December 7, 2023, the Compensation Committee of Rhythm’s board of directors granted inducement equity grants covering an aggregate of 10,500 shares of its common stock to o |

Rhythm Pharmaceuticals Sponsors Second Annual International Meeting on Pathway-Related Obesity: Vision & Evidence (IMPROVE) 2023-- More than 50 poster presentations highlighting new scientific developments to advance the care of people living with rare MC4R pathway diseases -- -- Approximately 150 healthcare professionals from 20 countries expected to attend -- BOSTON, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Rhythm Pharmaceuticals, Inc. (Nasdaq: RYTM), a commercial-stage biopharmaceutical company focused on transforming the lives of patients and their families living with hyperphagia and severe obesity caused by rare melanocor |

Insider Sell Alert: CFO Hunter Smith Sells 27,026 Shares of Rhythm Pharmaceuticals Inc (RYTM)In a recent transaction on December 6, 2023, Hunter Smith, the Chief Financial Officer (CFO) of Rhythm Pharmaceuticals Inc, sold a significant number of shares in the company. |

Rhythm Pharmaceuticals Announces Updates on MC4R Pathway Programs at R&D Event-- Phase 3 trial evaluating setmelanotide in pediatric patients ages 2-<6yo (N=12) over 52 weeks achieved primary endpoint -- -- Setmelanotide achieved 3.04 mean reduction in BMI-Z score and 18.4 percent mean reduction in BMI in patients ages 2-<6yo with obesity due to POMC/LEPR deficiency or BBS -- -- RM-718 showed potential to reduce body weight and hyperphagia with no off-target cardiovascular effects and no hyperpigmentation observed in pre-clinical studies; first in-human studies anticipate |

Insider Sell Alert: Joseph Shulman of Rhythm Pharmaceuticals Inc Cashes Out SharesIn the realm of biopharmaceuticals, insider transactions are often scrutinized for insights into the company's health and future prospects. |

RYTM Price Returns

| 1-mo | 23.02% |

| 3-mo | 28.13% |

| 6-mo | 10.60% |

| 1-year | 179.65% |

| 3-year | 157.75% |

| 5-year | 145.37% |

| YTD | 6.70% |

| 2023 | 57.86% |

| 2022 | 191.78% |

| 2021 | -66.43% |

| 2020 | 29.49% |

| 2019 | -14.58% |

Loading social stream, please wait...