Sabre Corporation (SABR): Price and Financial Metrics

SABR Price/Volume Stats

| Current price | $3.48 | 52-week high | $5.76 |

| Prev. close | $3.45 | 52-week low | $1.81 |

| Day low | $3.36 | Volume | 4,604,900 |

| Day high | $3.57 | Avg. volume | 4,841,743 |

| 50-day MA | $2.97 | Dividend yield | N/A |

| 200-day MA | $3.30 | Market Cap | 1.33B |

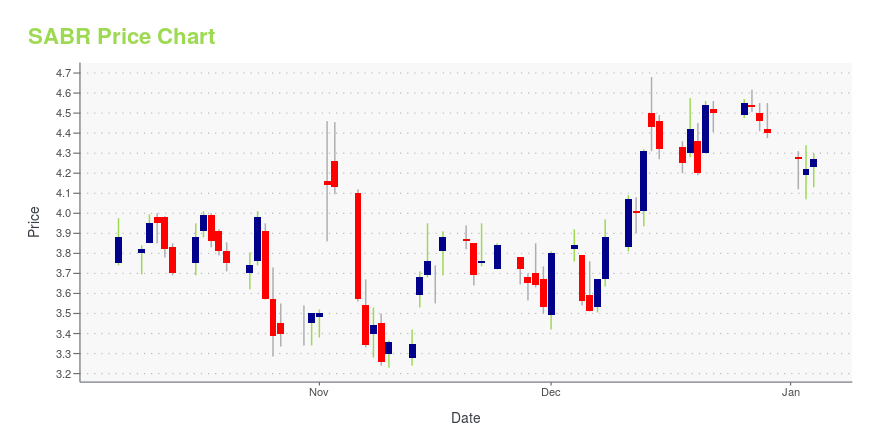

SABR Stock Price Chart Interactive Chart >

Sabre Corporation (SABR) Company Bio

Sabre Corporation provides technology solutions to the travel and tourism industry worldwide. It operates in two segments: Travel Network, and Airline and Hospitality Solutions. The company was founded in 2006 and is based in Southlake, Texas.

Latest SABR News From Around the Web

Below are the latest news stories about SABRE CORP that investors may wish to consider to help them evaluate SABR as an investment opportunity.

Warning Signs: 3 Companies That Might Not Survive 2024The number of at-risk companies that could file for bankruptcy in 2024 is expected to increase due to higher interest rates. |

Sabre (NASDAQ:SABR) shareholders have endured a 85% loss from investing in the stock five years agoLong term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see... |

When Will Sabre Corporation (NASDAQ:SABR) Breakeven?We feel now is a pretty good time to analyse Sabre Corporation's ( NASDAQ:SABR ) business as it appears the company may... |

The 3 Most Undervalued Tech Stocks to Buy Now: November 2023Growth stocks are rallying but there are still bargains to be found. |

Sabre's (SABR) GDS to Provide LOT Polish Airlines' NDC ContentSabre (SABR) and LOT Polish Airlines enter into a partnership, wherein the Poland flag carrier's NDC content has been integrated into Sabre's GDS. |

SABR Price Returns

| 1-mo | 33.85% |

| 3-mo | 24.29% |

| 6-mo | -22.67% |

| 1-year | -10.54% |

| 3-year | -70.38% |

| 5-year | -84.80% |

| YTD | -20.91% |

| 2023 | -28.80% |

| 2022 | -28.06% |

| 2021 | -28.54% |

| 2020 | -44.95% |

| 2019 | 6.32% |

Continue Researching SABR

Here are a few links from around the web to help you further your research on Sabre Corp's stock as an investment opportunity:Sabre Corp (SABR) Stock Price | Nasdaq

Sabre Corp (SABR) Stock Quote, History and News - Yahoo Finance

Sabre Corp (SABR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...