SAB Biotherapeutics, Inc., (SABS): Price and Financial Metrics

SABS Price/Volume Stats

| Current price | $2.80 | 52-week high | $10.50 |

| Prev. close | $2.86 | 52-week low | $2.36 |

| Day low | $2.65 | Volume | 2,920 |

| Day high | $2.92 | Avg. volume | 15,773 |

| 50-day MA | $2.97 | Dividend yield | N/A |

| 200-day MA | $5.55 | Market Cap | 25.84M |

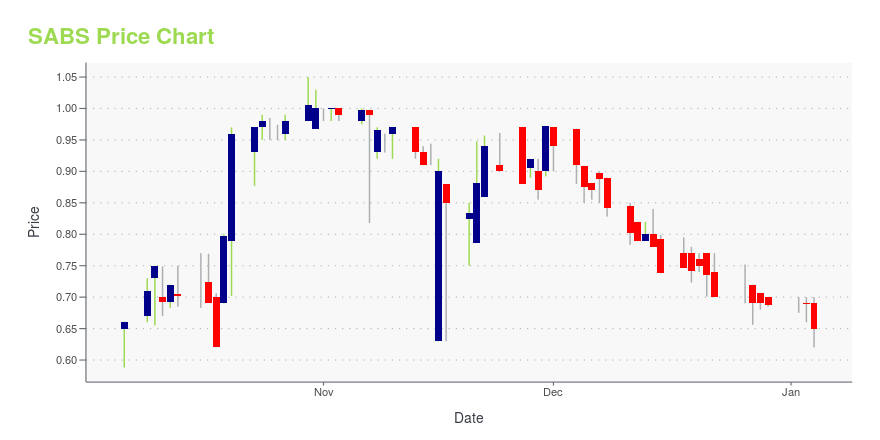

SABS Stock Price Chart Interactive Chart >

SAB Biotherapeutics, Inc., (SABS) Company Bio

SAB Biotherapeutics, Inc., a clinical-stage biopharmaceutical company, engages in the development of immunotherapies based on human antibodies. The company uses its DiversitAb immunotherapy platform to produce fully-human polyclonal antibodies without the need for human donors. Its lead product candidates include SAB-185, a fully-human polyclonal antibody therapeutic for the treatment of COVID-19 advancing as part of the NIH's ACTIV-2 protocol; and SAB-176, a fully-human polyclonal antibody therapeutic candidate designed to bind to type A and B viruses. The company's pre-clinical product candidates in development for autoimmune diseases include SAB-142 for type 1 diabetes and organ transplant induction/rejection; and SAB-181 for immune globulin (IgG) mediated diseases. It focuses on infectious diseases, such as COVID-19 and influenza, immune system disorders comprising type 1 diabetes, organ transplantation, and cancer. The company was founded in 2014 and is based in Miami Beach, Florida.

Latest SABS News From Around the Web

Below are the latest news stories about SAB BIOTHERAPEUTICS INC that investors may wish to consider to help them evaluate SABS as an investment opportunity.

SAB Biotherapeutics Starts Human Clinical Trial of Diabetes TreatmentBy Healthcare Edge Editorial Staff SAB Biotherapeutics, Inc. (Nasdaq: SABS), which is trying to slow down the progression of type 1 diabetes, said it started trials of SAB-142 on humans in Australia. SAB-142 is the first fully-human anti-thymocyte immunoglobulin treatment and this trial is the first-in-man clinical study, the company said. The program […] |

SAB Biotherapeutics Announces Commencement of the HUMAN Phase 1 Clinical Trial with SAB-142, a Potential Disease-Modifying Treatment for Type 1 DiabetesFirst subject has been dosed in the first-in-man Phase 1 clinical study of SAB-142, the first fully-human anti-thymocyte immunoglobulin (ATG) SAB-142 directly and specifically targets multiple immune cells involved in the destruction of insulin-producing pancreatic beta cells to potentially preserve beta cell function SAB Biotherapeutics is pursuing IND and CTA filings with U.S. FDA and EMA in 2024 to clinically advance development of SAB-142 into Phase 2b study SIOUX FALLS, S.D., Nov. 29, 2023 |

SAB Biotherapeutics Appoints Katie Ellias to the Board of DirectorsSIOUX FALLS, S.D., Nov. 20, 2023 (GLOBE NEWSWIRE) -- SAB Biotherapeutics (Nasdaq: SABS), a clinical-stage biopharmaceutical company with a novel immunotherapy platform that is developing a fully-human anti-thymocyte immunoglobulin (hIgG) for delaying the onset or progression of type 1 diabetes (T1D), today announced that Katie Ellias has been appointed to the Company’s Board of Directors. With Ms. Ellias’ appointment, the SAB Biotherapeutics Board is composed of ten directors, eight of whom are |

SAB Biotherapeutics 3Q Loss Narrows, Completes $67.1M in FinancingBy Karen E. Roman SAB Biotherapeutics, Inc. (Nasdaq: SABS), a clinical-stage company developing a fully-human treatment to delay the progress of type 1 diabetes, said its net loss narrowed in the third quarter. The net loss was $5.1 million, compared to $7.1 million a year earlier, mainly due to cost reduction measures and increased […] |

SAB Biotherapeutics Announces Completion of $67.1 Million Financing to Advance Potential Disease-Modifying Treatment for Type 1 DiabetesFunding will support development of SAB-142, a potential disease-modifying therapy for type 1 diabetes and other autoimmune conditionsParticipating investors include Sessa Capital, BVF Partners, RTW Investments, Marshall Wace, ATW, and the JDRF T1D FundFunds are expected to sustain development of SAB-142 through Phase 1 trial SIOUX FALLS, S.D., Nov. 14, 2023 (GLOBE NEWSWIRE) -- SAB Biotherapeutics, Inc. (NASDAQ: SABS), a clinical stage biopharmaceutical company with a novel immunotherapy platfor |

SABS Price Returns

| 1-mo | -1.06% |

| 3-mo | -34.12% |

| 6-mo | -53.14% |

| 1-year | -66.98% |

| 3-year | -97.19% |

| 5-year | N/A |

| YTD | -59.27% |

| 2023 | 16.55% |

| 2022 | -92.45% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...