Sanmina Corporation (SANM): Price and Financial Metrics

SANM Price/Volume Stats

| Current price | $74.33 | 52-week high | $75.35 |

| Prev. close | $73.25 | 52-week low | $43.40 |

| Day low | $73.59 | Volume | 265,700 |

| Day high | $75.35 | Avg. volume | 428,888 |

| 50-day MA | $68.00 | Dividend yield | N/A |

| 200-day MA | $58.99 | Market Cap | 4.15B |

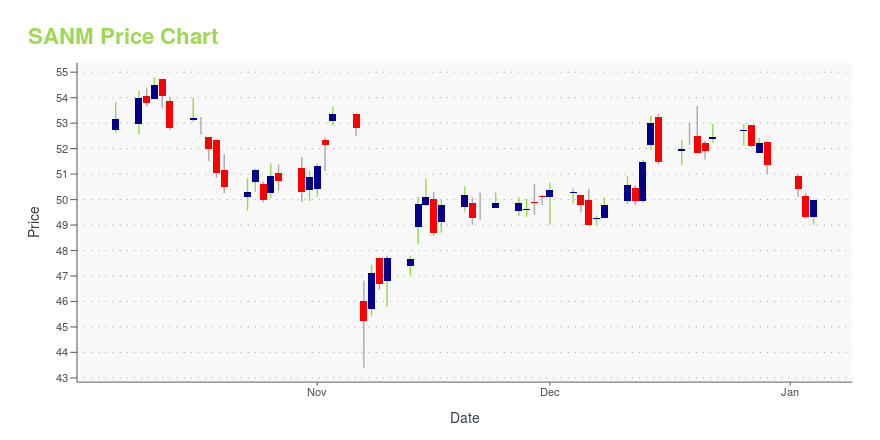

SANM Stock Price Chart Interactive Chart >

Sanmina Corporation (SANM) Company Bio

Sanmina provides end-to-end manufacturing solutions, delivering support to OEMs primarily in the communications, defense and aerospace, industrial and semiconductor systems, medical, multimedia, computing and storage, automotive and clean technology sectors. The company was founded in 1980 and is based in San Jose, California.

Latest SANM News From Around the Web

Below are the latest news stories about SANMINA CORP that investors may wish to consider to help them evaluate SANM as an investment opportunity.

Double Your Money: 3 Ignored Stocks Primed for Mega Growth in 2025Are you looking for stocks to double your money? |

3 Hidden-Gem Stocks to Watch for a 900% Return by 2026In the vast labyrinth of investment options there lies diamonds in the rough—companies often overlooked yet brimming with exceptional potential. |

SANMINA APPOINTS JON FAUST AS EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICERSanmina Corporation ("Sanmina" or the "Company") (NASDAQ: SANM), a leading integrated manufacturing solutions company, announced today that Jon Faust has been appointed Executive Vice President and Chief Financial Officer, effective December 18, 2023. Kurt Adzema, who previously held this role, will remain with the Company in an advisory capacity until January 5, 2024. |

Insider Sell Alert: Director Eugene Delaney Sells 8,598 Shares of Sanmina Corp (SANM)In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. |

3 Mid-Cap Stocks Ready to RallyInvest beyond the mega-caps with these top mid-cap stocks to buy for robust long-term gains ahead of a likely bull run in 2024. |

SANM Price Returns

| 1-mo | 13.58% |

| 3-mo | 18.04% |

| 6-mo | 46.81% |

| 1-year | 24.11% |

| 3-year | 97.48% |

| 5-year | 126.06% |

| YTD | 44.70% |

| 2023 | -10.33% |

| 2022 | 38.18% |

| 2021 | 30.01% |

| 2020 | -6.86% |

| 2019 | 42.31% |

Continue Researching SANM

Want to do more research on Sanmina Corp's stock and its price? Try the links below:Sanmina Corp (SANM) Stock Price | Nasdaq

Sanmina Corp (SANM) Stock Quote, History and News - Yahoo Finance

Sanmina Corp (SANM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...