Seacoast Banking Corporation of Florida (SBCF): Price and Financial Metrics

SBCF Price/Volume Stats

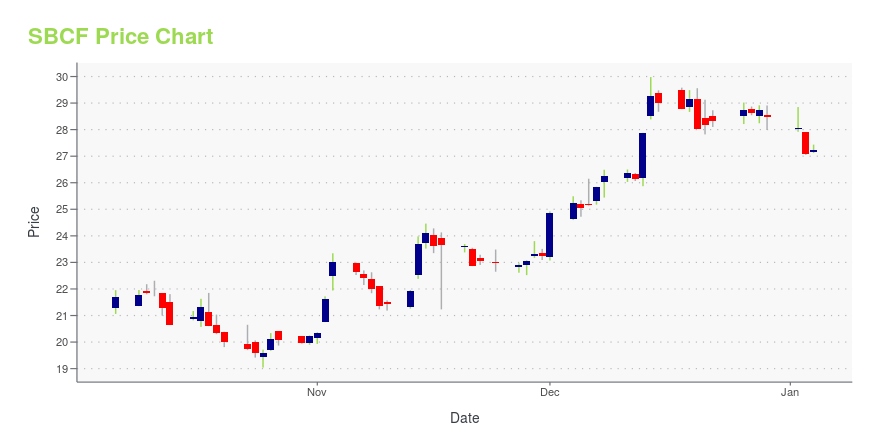

| Current price | $28.70 | 52-week high | $29.98 |

| Prev. close | $28.66 | 52-week low | $19.04 |

| Day low | $28.16 | Volume | 584,328 |

| Day high | $29.44 | Avg. volume | 418,045 |

| 50-day MA | $24.21 | Dividend yield | 2.52% |

| 200-day MA | $24.27 | Market Cap | 2.44B |

SBCF Stock Price Chart Interactive Chart >

Seacoast Banking Corporation of Florida (SBCF) Company Bio

Seacoast Banking Corporation of Florida operates as the bank holding company for Seacoast National Bank that provides community banking services to the commercial, small business, and retail customers in Florida. The company was founded in 1926 and is based in Stuart, Florida.

Latest SBCF News From Around the Web

Below are the latest news stories about SEACOAST BANKING CORP OF FLORIDA that investors may wish to consider to help them evaluate SBCF as an investment opportunity.

Seacoast Banking Corporation of Florida Announces Renewal of Share Repurchase ProgramSTUART, Fla., Dec. 15, 2023 (GLOBE NEWSWIRE) -- Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) (NASDAQ: SBCF) announced that its Board of Directors (the “Board”) has renewed the Company's share repurchase program, which was set to expire on December 31, 2023. Under the renewed repurchase program, which will expire on December 31, 2024, the Company may repurchase, from time to time, up to $100 million of its shares of common stock, representing approximately 4% of the Compa |

Seacoast Banking (SBCF) Moves 5.1% Higher: Will This Strength Last?Seacoast Banking (SBCF) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might help the stock continue moving higher in the near term. |

Seacoast Banking Corporation of Florida's (NASDAQ:SBCF) Dividend Will Be $0.18Seacoast Banking Corporation of Florida ( NASDAQ:SBCF ) will pay a dividend of $0.18 on the 29th of December. Based on... |

Is It Worth Considering Seacoast Banking Corporation of Florida (NASDAQ:SBCF) For Its Upcoming Dividend?Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Seacoast Banking Corporation of Florida (NASDAQ:SBCF) Q3 2023 Earnings Call TranscriptSeacoast Banking Corporation of Florida (NASDAQ:SBCF) Q3 2023 Earnings Call Transcript October 27, 2023 Operator: Welcome to Seacoast Banking Corporation’s Third Quarter 2023 Earnings Conference Call. My name is Daisy, and I will be your operator. During the presentation, all participants will be in a listen-only mode. Afterwards, we will conduct a question-and-answer session. [Operator […] |

SBCF Price Returns

| 1-mo | 25.71% |

| 3-mo | 23.72% |

| 6-mo | 11.39% |

| 1-year | 10.85% |

| 3-year | 1.45% |

| 5-year | 13.33% |

| YTD | 2.39% |

| 2023 | -5.97% |

| 2022 | -10.10% |

| 2021 | 21.07% |

| 2020 | -3.66% |

| 2019 | 17.49% |

SBCF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SBCF

Want to see what other sources are saying about Seacoast Banking Corp Of Florida's financials and stock price? Try the links below:Seacoast Banking Corp Of Florida (SBCF) Stock Price | Nasdaq

Seacoast Banking Corp Of Florida (SBCF) Stock Quote, History and News - Yahoo Finance

Seacoast Banking Corp Of Florida (SBCF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...