Splash Beverage Group Inc. (SBEV): Price and Financial Metrics

SBEV Price/Volume Stats

| Current price | $2.69 | 52-week high | $20.80 |

| Prev. close | $2.56 | 52-week low | $0.96 |

| Day low | $2.51 | Volume | 46,000 |

| Day high | $2.72 | Avg. volume | 982,409 |

| 50-day MA | $3.79 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 5.11M |

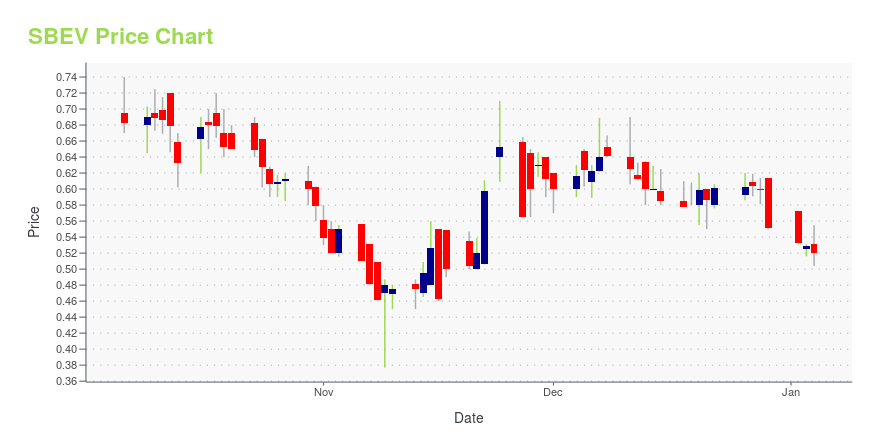

SBEV Stock Price Chart Interactive Chart >

Splash Beverage Group Inc. (SBEV) Company Bio

Splash Beverage Group, Inc. produces, distributes, and markets various beverages in the United States. The company offers hydration and recovery isotonic sport drink under the TapouT Performance brand; and flavored tequilas under the SALT Naturally Flavored Tequila brand. It also sells beverages and groceries online through qplash.com; produces premium wine under the Copa di Vino brand; and offers premium Pulpoloco Sangria. The company is based in Fort Lauderdale, Florida.

SBEV Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -76.16% |

| 3-year | -97.89% |

| 5-year | -97.52% |

| YTD | -58.23% |

| 2024 | -70.85% |

| 2023 | -42.54% |

| 2022 | -17.69% |

| 2021 | -66.72% |

| 2020 | 37.65% |

Loading social stream, please wait...