Sibanye-Stillwater Ltd. ADR (SBSW): Price and Financial Metrics

SBSW Price/Volume Stats

| Current price | $4.29 | 52-week high | $7.78 |

| Prev. close | $4.32 | 52-week low | $3.85 |

| Day low | $4.27 | Volume | 3,037,548 |

| Day high | $4.41 | Avg. volume | 5,983,415 |

| 50-day MA | $4.75 | Dividend yield | 2% |

| 200-day MA | $4.86 | Market Cap | 3.04B |

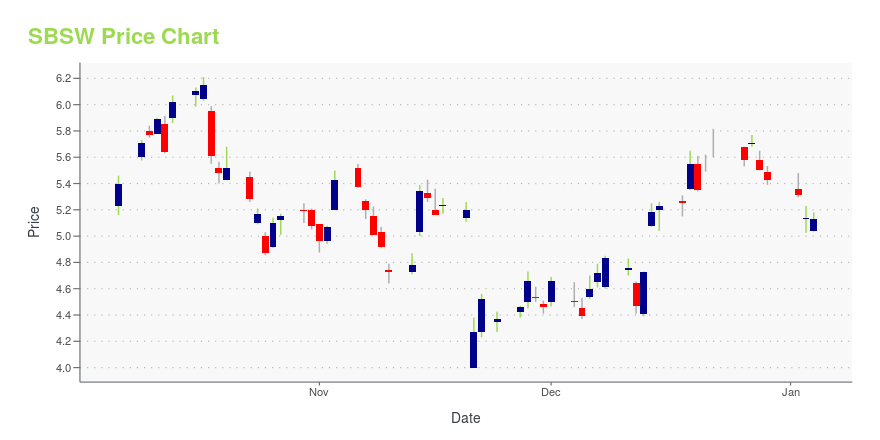

SBSW Stock Price Chart Interactive Chart >

Sibanye-Stillwater Ltd. ADR (SBSW) Company Bio

Sibanye-Stillwater is a multinational precious metals mining company, revealing a diverse portfolio of platinum group metals (PGM) in South Africa (SA) and the United States (US), gold and base metals operations and various mining projects in South Africa and the Americas. (Source:Wikipedia)

Latest SBSW News From Around the Web

Below are the latest news stories about SIBANYE STILLWATER LTD that investors may wish to consider to help them evaluate SBSW as an investment opportunity.

3 Hidden Champions: The ‘Stealth Wealth’ Stocks Set to Soar in 2024Various hidden gem stocks are available with USB, SBSW, and LVMH looking best-in-class amid their overlooked value stock attributes. |

Sibanye Stillwater Layoffs 2023: What to Know About the Latest SBSW Job CutsSibanye Stillwater (SBSW) will lay off employees of its U.S. platinum unit. |

U.S. Steel Layoffs 2023: What to Know About the Latest U.S. Steel Job CutsU.S. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to start Tuesday trading with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

Buy These 3 Stocks as They Hit 52-Week LowsOversold stocks are the name of the game at the moment, with stocks at 52-week lows. |

SBSW Price Returns

| 1-mo | -2.50% |

| 3-mo | -12.98% |

| 6-mo | -11.36% |

| 1-year | -39.80% |

| 3-year | -70.59% |

| 5-year | 0.50% |

| YTD | -20.99% |

| 2023 | -47.07% |

| 2022 | -10.75% |

| 2021 | -14.40% |

| 2020 | 61.23% |

| 2019 | 250.89% |

SBSW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...