Socket Mobile, Inc. (SCKT): Price and Financial Metrics

SCKT Price/Volume Stats

| Current price | $1.14 | 52-week high | $1.59 |

| Prev. close | $1.12 | 52-week low | $0.90 |

| Day low | $1.12 | Volume | 2,800 |

| Day high | $1.15 | Avg. volume | 16,464 |

| 50-day MA | $1.20 | Dividend yield | N/A |

| 200-day MA | $1.13 | Market Cap | 8.60M |

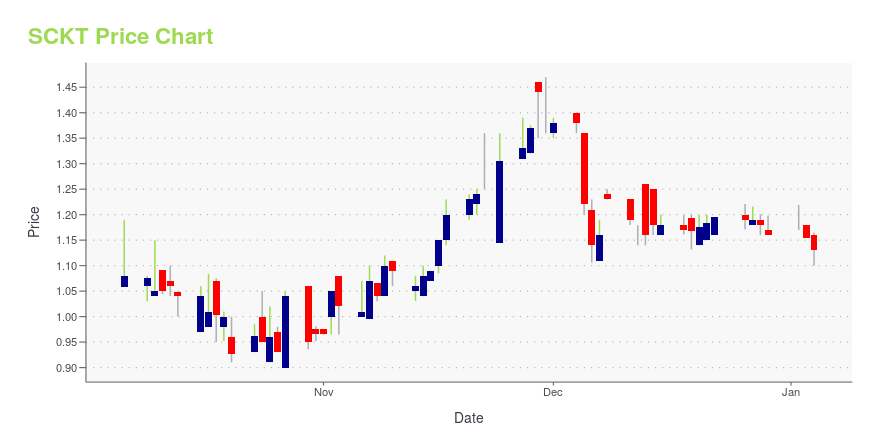

SCKT Stock Price Chart Interactive Chart >

Socket Mobile, Inc. (SCKT) Company Bio

Socket Mobile, Inc. provides other hardware products. The Company wide range of scanners and identifications systems for retail, commercial, transportation, and health care sectors. Socket Mobile serves clients worldwide.

Latest SCKT News From Around the Web

Below are the latest news stories about SOCKET MOBILE INC that investors may wish to consider to help them evaluate SCKT as an investment opportunity.

Socket Mobile Announces Comprehensive Recycling and Trade-In ProgramSocket Mobile, a leading data capture and delivery solutions provider, is proud to announce its comprehensive Recycling Center and Outlet Store, marking a significant stride in its commitment to environmental sustainability and responsible global citizenship. |

Socket Mobile Announces its SocketScan S550 NFC Mobile Wallet Reader is Apple VAS CertifiedSocket Mobile, Inc. (NASDAQ: SCKT), a leading provider of data capture and delivery solutions designed to enhance workplace productivity, is excited to announce that its SocketScan S550 NFC Mobile Wallet Reader is Apple® VAS Certified. |

Socket Mobile Adds Upgrade Option to Free Camera Barcode Scanner on AndroidSocket Mobile, Inc. (NASDAQ: SCKT), a leading provider of data capture and delivery solutions designed to enhance workplace productivity, is excited to announce it is now possible to upgrade from its free SocketCam C820 to the SocketCam C860, an enhanced camera-based barcode scanner for Android. |

Socket Mobile's SocketScan S370 Universal NFC & QR Code Mobile Wallet Reader Receives NFC Forum CertificationSocket Mobile, Inc. (NASDAQ: SCKT), a leading provider of data capture and delivery solutions designed to enhance workplace productivity, is excited to announce that its SocketScan S370 Universal NFC & QR Code Mobile Wallet Reader has achieved certification from the NFC Forum Certification Program. |

Socket Mobile, Inc. (NASDAQ:SCKT) Q3 2023 Earnings Call TranscriptSocket Mobile, Inc. (NASDAQ:SCKT) Q3 2023 Earnings Call Transcript October 27, 2023 Operator: Welcome to the Socket Mobile Inc. Q3 2023 Earnings Call. My name is Jen, and I will be your operator for today’s call. Before we begin, I’d like to remind everyone that this conference call may contain forward-looking statements within the meaning […] |

SCKT Price Returns

| 1-mo | 5.56% |

| 3-mo | 11.55% |

| 6-mo | 0.00% |

| 1-year | -23.49% |

| 3-year | -83.09% |

| 5-year | -55.47% |

| YTD | -1.72% |

| 2023 | -39.90% |

| 2022 | -52.70% |

| 2021 | 71.43% |

| 2020 | 47.83% |

| 2019 | 7.33% |

Continue Researching SCKT

Want to do more research on Socket Mobile Inc's stock and its price? Try the links below:Socket Mobile Inc (SCKT) Stock Price | Nasdaq

Socket Mobile Inc (SCKT) Stock Quote, History and News - Yahoo Finance

Socket Mobile Inc (SCKT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...