SciPlay Corporation - (SCPL): Price and Financial Metrics

SCPL Price/Volume Stats

| Current price | $22.94 | 52-week high | $22.96 |

| Prev. close | $22.94 | 52-week low | $12.05 |

| Day low | $22.94 | Volume | 812,100 |

| Day high | $22.95 | Avg. volume | 421,588 |

| 50-day MA | $22.77 | Dividend yield | N/A |

| 200-day MA | $19.04 | Market Cap | 2.86B |

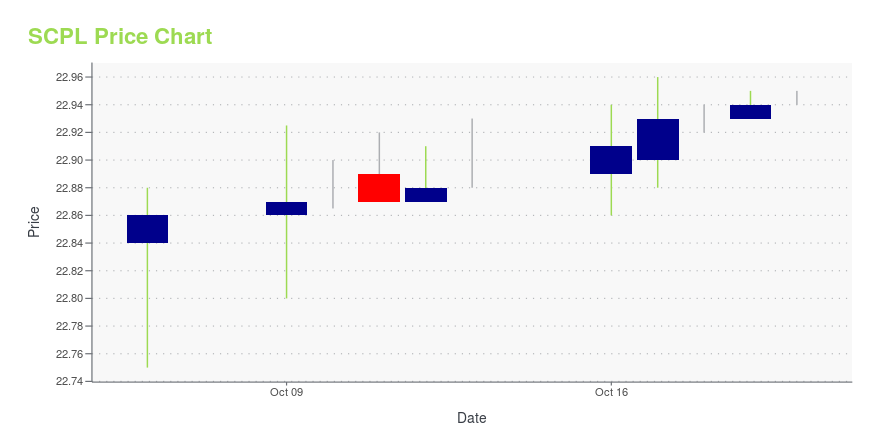

SCPL Stock Price Chart Interactive Chart >

SciPlay Corporation - (SCPL) Company Bio

SciPlay Corp. engages in the development and publishing of digital games on mobile and web platforms. It offers social casino games that include Jackpot Party Casino, Gold Fish Casino, Hot Shot Casino and Quick Hit Slots, and casual games which include Monopoly Slots, Bingo Showdown and 88 Fortunes Slots. The company was founded on November 30, 2018 and is headquartered in Las Vegas, NV.

Latest SCPL News From Around the Web

Below are the latest news stories about SCIPLAY CORP that investors may wish to consider to help them evaluate SCPL as an investment opportunity.

ARS Pharmaceuticals, Harmonic, and More Stocks See Action From Activist InvestorsScopia Management disclosed a large stake in streaming and broadband-services firm Harmonic. Gamco Investors raised its stake in digital-games maker SciPlay. |

UBSFY vs. SCPL: Which Stock Is the Better Value Option?UBSFY vs. SCPL: Which Stock Is the Better Value Option? |

UBSFY or SCPL: Which Is the Better Value Stock Right Now?UBSFY vs. SCPL: Which Stock Is the Better Value Option? |

We Ran A Stock Scan For Earnings Growth And SciPlay (NASDAQ:SCPL) Passed With EaseIt's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story... |

Sleep Number, Newell Brands, and More Stocks See Action From Activist InvestorsActivists file with the SEC on Sleep Number, Newell Brands, Donnelley Financial Solutions, and Alkermes |

SCPL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 16.03% |

| 3-year | 48.38% |

| 5-year | 114.19% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 16.69% |

| 2021 | -0.51% |

| 2020 | 12.69% |

| 2019 | N/A |

Loading social stream, please wait...