ScanSource, Inc. (SCSC): Price and Financial Metrics

SCSC Price/Volume Stats

| Current price | $50.38 | 52-week high | $50.95 |

| Prev. close | $49.00 | 52-week low | $26.99 |

| Day low | $49.25 | Volume | 157,079 |

| Day high | $50.47 | Avg. volume | 212,281 |

| 50-day MA | $46.30 | Dividend yield | N/A |

| 200-day MA | $40.51 | Market Cap | 1.24B |

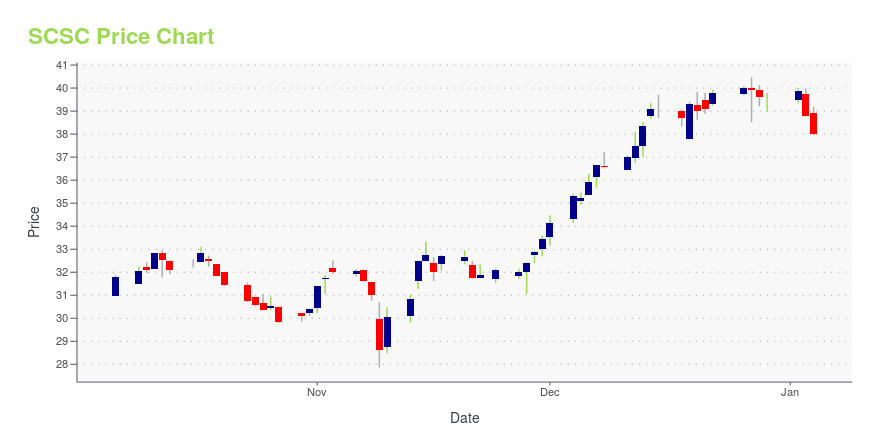

SCSC Stock Price Chart Interactive Chart >

ScanSource, Inc. (SCSC) Company Bio

ScanSource, Inc. operates as a wholesale distributor of specialty technology products in North America and internationally. It operates in two segments, Worldwide Barcode & Security and Worldwide Communications & Services. The company was founded in 1992 and is based in Greenville, South Carolina.

Latest SCSC News From Around the Web

Below are the latest news stories about SCANSOURCE INC that investors may wish to consider to help them evaluate SCSC as an investment opportunity.

MicroMarvel: ScanScourceScanSource has seen significant price appreciation since a buy signal was given on November 30th, gaining 18.52%. |

Analysts on Wall Street Lower Ratings for These 10 StocksIn this article, we will discuss the 10 stocks recently downgraded by analysts. If you want to see more such stocks on the list, you can directly visit Analysts on Wall Street Lower Ratings for These 5 Stocks. European financial markets experienced significant movements on Wednesday, with stocks recording gains and bond yields across the euro […] |

Returns Are Gaining Momentum At ScanSource (NASDAQ:SCSC)If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an... |

ScanSource to Present at Raymond James TMT & Consumer ConferenceGREENVILLE, S.C., November 30, 2023--ScanSource, Inc. (NASDAQ: SCSC), a leading hybrid distributor connecting devices to the cloud, announced plans to present at the Raymond James TMT & Consumer Conference in New York City. |

ScanSource (SCSC) Q1 Earnings Miss Estimates, Decline Y/YScanSource (SCSC) witnesses year-over-year declines in both its top and bottom line on weak demand and higher interest expenses. |

SCSC Price Returns

| 1-mo | 14.21% |

| 3-mo | 20.04% |

| 6-mo | 26.77% |

| 1-year | 66.05% |

| 3-year | 94.59% |

| 5-year | 49.32% |

| YTD | 27.19% |

| 2023 | 35.56% |

| 2022 | -16.70% |

| 2021 | 32.98% |

| 2020 | -28.61% |

| 2019 | 7.48% |

Continue Researching SCSC

Want to see what other sources are saying about Scansource Inc's financials and stock price? Try the links below:Scansource Inc (SCSC) Stock Price | Nasdaq

Scansource Inc (SCSC) Stock Quote, History and News - Yahoo Finance

Scansource Inc (SCSC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...