L.S. Starrett Company (The) (SCX): Price and Financial Metrics

SCX Price/Volume Stats

| Current price | $16.18 | 52-week high | $16.19 |

| Prev. close | $16.17 | 52-week low | $8.55 |

| Day low | $16.17 | Volume | 61,600 |

| Day high | $16.19 | Avg. volume | 64,664 |

| 50-day MA | $16.00 | Dividend yield | N/A |

| 200-day MA | $12.36 | Market Cap | 121.56M |

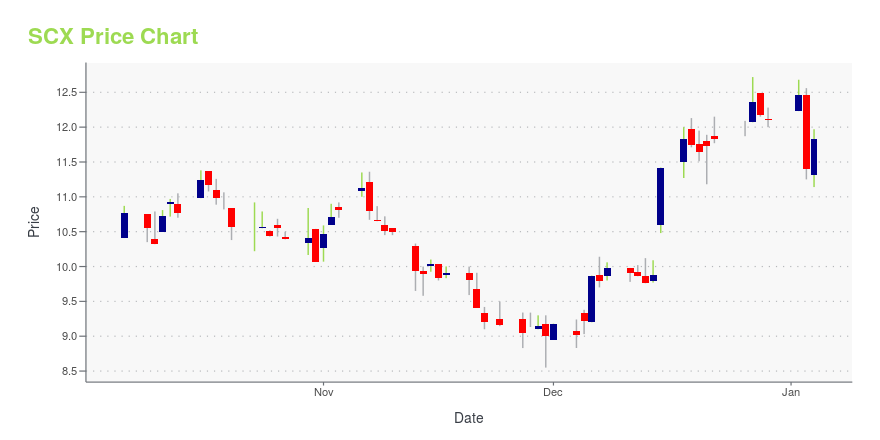

SCX Stock Price Chart Interactive Chart >

L.S. Starrett Company (The) (SCX) Company Bio

The L.S. Starrett Company, together with its subsidiaries, manufactures and sells industrial, professional, and consumer measuring and cutting tools, and related products in the United States, Canada, Mexico, Brazil, China, the United Kingdom, Australia, and New Zealand. The company's products include precision tools, electronic gages, gage blocks, optical vision and laser measuring equipment, custom engineered granite solutions, squares, band saw blades, hole saws, hacksaw blades, jig saw blades, and reciprocating saw blades, as well as M1 lubricant and precision ground flat stock products. It also provides measuring tools, such as micrometers, vernier calipers, height gages, depth gages, electronic gages, dial indicators, steel rules, and combination squares, as well as custom and non-contact gaging. In addition, the company offers hand tools for measuring, marking, and layout that include tapes, levels, chalk lines, and other products for building trades, and construction and retail trades. Further, it provides carbide tipped products for cutting ferrous materials, and non-ferrous metals and castings. The company primarily distributes its precision hand tools, and saw and construction products through distributors or resellers. It serves the metalworking, aerospace, medical, oil and gas, machinery, government, equipment, and automotive markets; marine and farm equipment shops, and do-it-yourselfers; and tradesmen, which comprise builders, carpenters, plumbers, and electricians. The L.S. Starrett Company was founded in 1880 and is headquartered in Athol, Massachusetts.

Latest SCX News From Around the Web

Below are the latest news stories about STARRETT L S CO that investors may wish to consider to help them evaluate SCX as an investment opportunity.

The L.S. Starrett Company Announces Fiscal 2024 First Quarter ResultsATHOL, Mass., November 13, 2023--The L.S. Starrett Company (NYSE: SCX) ("Starrett" or "the Company") a global innovator, manufacturer and marketer of precision measuring tools, cutting tools and equipment, and high-end metrology solutions for industrial, professional, and consumer markets, today announced operating results for the quarter ended September 30, 2023. |

Does L.S. Starrett (NYSE:SCX) Deserve A Spot On Your Watchlist?It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story... |

Investors in L.S. Starrett (NYSE:SCX) have seen impressive returns of 247% over the past three yearsThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

The L.S. Starrett Company Announces Fiscal 2023 ResultsATHOL, Mass., September 15, 2023--The L.S. Starrett Company (NYSE: SCX) ("Starrett" or "the Company") a global innovator, manufacturer and marketer of precision measuring tools, cutting tools and equipment, and high-end metrology solutions for industrial, professional, and consumer markets, today announced operating results for the fiscal year ended June 30, 2023. |

We Like These Underlying Return On Capital Trends At L.S. Starrett (NYSE:SCX)To find a multi-bagger stock, what are the underlying trends we should look for in a business? One common approach is... |

SCX Price Returns

| 1-mo | N/A |

| 3-mo | 1.00% |

| 6-mo | 19.85% |

| 1-year | 43.69% |

| 3-year | 99.75% |

| 5-year | 158.47% |

| YTD | 33.72% |

| 2023 | 64.40% |

| 2022 | -21.28% |

| 2021 | 121.04% |

| 2020 | -26.05% |

| 2019 | 9.37% |

Continue Researching SCX

Want to see what other sources are saying about Starrett L S Co's financials and stock price? Try the links below:Starrett L S Co (SCX) Stock Price | Nasdaq

Starrett L S Co (SCX) Stock Quote, History and News - Yahoo Finance

Starrett L S Co (SCX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...