SeaWorld Entertainment, Inc. (SEAS): Price and Financial Metrics

SEAS Price/Volume Stats

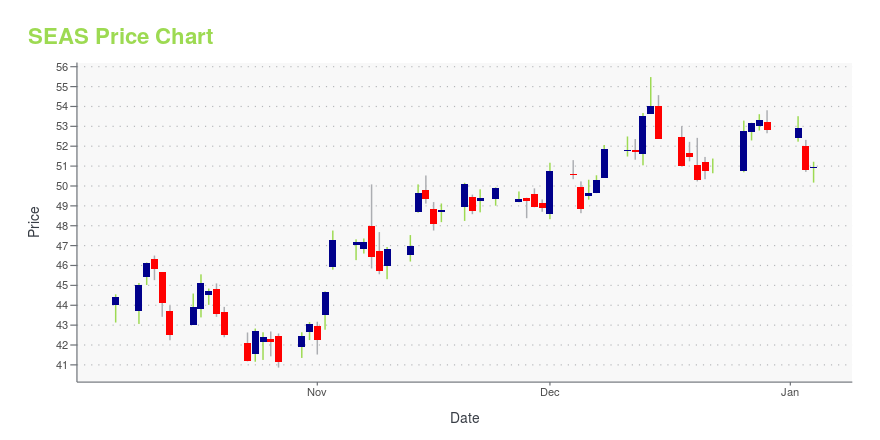

| Current price | $50.30 | 52-week high | $68.19 |

| Prev. close | $49.08 | 52-week low | $40.87 |

| Day low | $48.87 | Volume | 504,300 |

| Day high | $50.41 | Avg. volume | 727,438 |

| 50-day MA | $50.74 | Dividend yield | N/A |

| 200-day MA | $51.00 | Market Cap | 3.22B |

SEAS Stock Price Chart Interactive Chart >

SeaWorld Entertainment, Inc. (SEAS) Company Bio

Seaworld Entertainment operates as a theme park and entertainment company in the United States, with its flagship location being Seaworld in Orlando, Florida. The company was founded in 1959 and is based in Orlando, Florida.

Latest SEAS News From Around the Web

Below are the latest news stories about SEAWORLD ENTERTAINMENT INC that investors may wish to consider to help them evaluate SEAS as an investment opportunity.

Will Theme Park Stocks Bounce Back in 2024?All but one of the major theme park operators lost to the market in 2023. Next year should be better. |

Those who invested in SeaWorld Entertainment (NYSE:SEAS) five years ago are up 85%Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the... |

Here's What to Expect From Johnson Outdoors' (JOUT) Q4 EarningsElevated retail inventories and warranty expenses and advertising and promotion costs are likely to have dented Johnson Outdoors' (JOUT) Q4 performance. |

SeaWorld Entertainment, Inc. (NYSE:SEAS) Q3 2023 Earnings Call TranscriptSeaWorld Entertainment, Inc. (NYSE:SEAS) Q3 2023 Earnings Call Transcript November 8, 2023 SeaWorld Entertainment, Inc. beats earnings expectations. Reported EPS is $1.92, expectations were $1.91. Operator: Good morning, and welcome to the SeaWorld Parks and Entertainment Q3 2023 Earnings Conference Call. [Operator Instructions] Please note, this event is being recorded. I would now like to […] |

SeaWorld's (SEAS) Q3 Earnings Meet, Revenues Beat, Down Y/YSeaWorld's (SEAS) third-quarter 2023 results reflect a decline in admissions and adverse weather impacts, especially during its peak operating season. |

SEAS Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -1.18% |

| 1-year | -5.68% |

| 3-year | 9.25% |

| 5-year | 62.78% |

| YTD | -4.79% |

| 2023 | -1.27% |

| 2022 | -17.50% |

| 2021 | 105.32% |

| 2020 | -0.38% |

| 2019 | 43.55% |

Continue Researching SEAS

Want to see what other sources are saying about SeaWorld Entertainment Inc's financials and stock price? Try the links below:SeaWorld Entertainment Inc (SEAS) Stock Price | Nasdaq

SeaWorld Entertainment Inc (SEAS) Stock Quote, History and News - Yahoo Finance

SeaWorld Entertainment Inc (SEAS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...