Seer Inc. Cl A (SEER): Price and Financial Metrics

SEER Price/Volume Stats

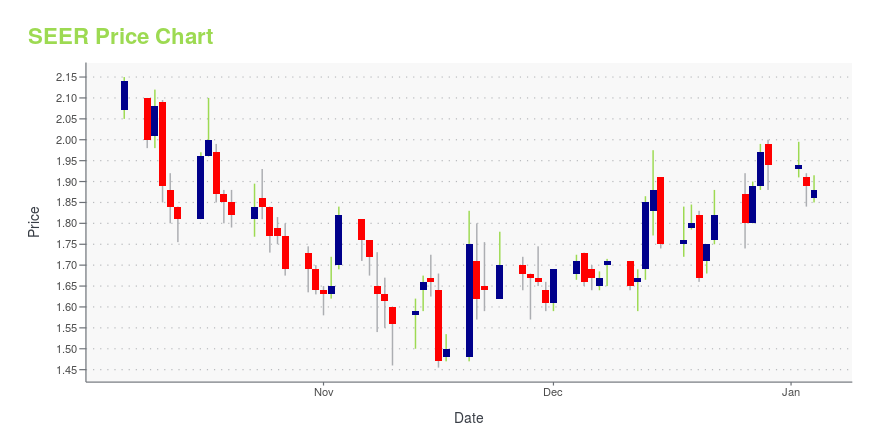

| Current price | $2.07 | 52-week high | $5.13 |

| Prev. close | $2.06 | 52-week low | $1.46 |

| Day low | $2.05 | Volume | 375,599 |

| Day high | $2.12 | Avg. volume | 530,848 |

| 50-day MA | $1.82 | Dividend yield | N/A |

| 200-day MA | $1.80 | Market Cap | 134.08M |

SEER Stock Price Chart Interactive Chart >

Seer Inc. Cl A (SEER) Company Bio

Seer, Inc., a life sciences company, engages in developing nanoparticle technology solutions for researchers in the areas of proteomics information. The company develops Proteograph, an integrated solution comprising consumables, automation instrumentation, and proprietary software that performs proteomics analysis. It intends to sell its products for research purposes, which cover academic institutions, life sciences, and research laboratories, as well as biopharmaceutical and biotechnology companies for non-diagnostic and non-clinical purposes. The company was formerly known as Seer Biosciences, Inc. and changed its name to Seer, Inc. in July 2018. Seer, Inc. was incorporated in 2017 and is headquartered in Redwood City, California.

Latest SEER News From Around the Web

Below are the latest news stories about SEER INC that investors may wish to consider to help them evaluate SEER as an investment opportunity.

Need To Know: The Consensus Just Cut Its Seer, Inc. (NASDAQ:SEER) Estimates For 2024One thing we could say about the analysts on Seer, Inc. ( NASDAQ:SEER ) - they aren't optimistic, having just made a... |

Seer to Present at the Canaccord MedTech, Diagnostics and Digital Health & Services ForumREDWOOD CITY, Calif., Nov. 10, 2023 (GLOBE NEWSWIRE) -- Seer, Inc. (Nasdaq: SEER), a leading life sciences company commercializing a disruptive new platform for proteomics, today announced company management will be participating in the upcoming Canaccord MedTech, Diagnostics and Digital Health and Services Forum in New York, NY. Seer’s management is scheduled to present on Thursday, November 16th at 1:00 p.m. Eastern Time / 10:00 a.m. Pacific Time. A live webcast of the session will be availabl |

Seer, Inc. (NASDAQ:SEER) Q3 2023 Earnings Call TranscriptSeer, Inc. (NASDAQ:SEER) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good day, and thank you for standing by. Welcome to the Seer Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions]. Please be advised […] |

Seer Wins Proteomics Solution of the Year by BioTech Breakthrough and Named #5 on Deloitte Technology Fast 500Seer technology receives recognition for excellence in the field of proteomicsREDWOOD CITY, Calif., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Seer, Inc. (NASDAQ: SEER), a leading life sciences company commercializing a disruptive new platform for proteomics, today announced that the company was selected as “Proteomics Solution of the Year” in the 2023 BioTech Breakthrough Awards program as well as being named to the 2023 Deloitte Technology Fast 500. “After launching our Proteograph XT Assay Kit this ye |

Seer, Inc. (SEER) Reports Q3 Loss, Tops Revenue EstimatesSeer, Inc. (SEER) delivered earnings and revenue surprises of 13.16% and 5.37%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

SEER Price Returns

| 1-mo | 23.95% |

| 3-mo | 8.38% |

| 6-mo | 16.95% |

| 1-year | -57.84% |

| 3-year | -93.35% |

| 5-year | N/A |

| YTD | 6.70% |

| 2023 | -66.55% |

| 2022 | -74.57% |

| 2021 | -59.37% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...