Selecta Biosciences, Inc. (SELB): Price and Financial Metrics

SELB Price/Volume Stats

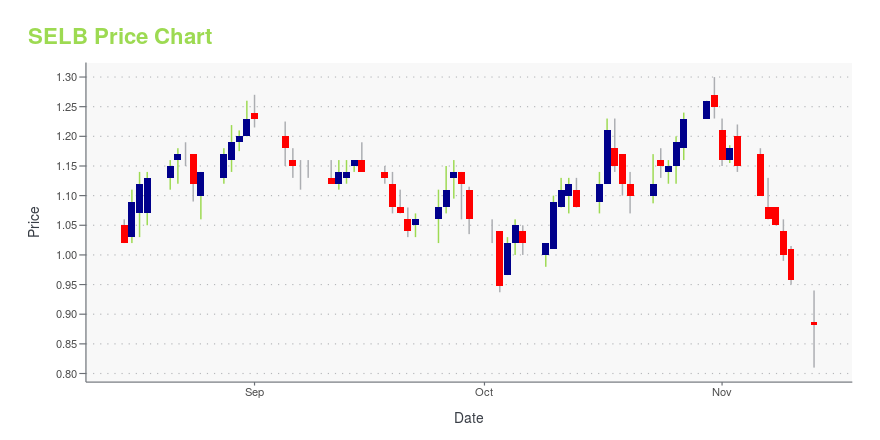

| Current price | $0.88 | 52-week high | $1.99 |

| Prev. close | $0.96 | 52-week low | $0.81 |

| Day low | $0.81 | Volume | 2,774,100 |

| Day high | $0.94 | Avg. volume | 979,585 |

| 50-day MA | $1.11 | Dividend yield | N/A |

| 200-day MA | $1.24 | Market Cap | 136.77M |

SELB Stock Price Chart Interactive Chart >

Selecta Biosciences, Inc. (SELB) Company Bio

Selecta Biosciences, Inc., a clinical-stage biotechnology company, develops targeted therapies that use immunomodulators encapsulated in nanoparticles to induce antigen-specific immune responses to prevent and treat disease. The company was founded in 2007 and is based in Watertown, Massachusetts.

Latest SELB News From Around the Web

Below are the latest news stories about SELECTA BIOSCIENCES INC that investors may wish to consider to help them evaluate SELB as an investment opportunity.

Further weakness as Selecta Biosciences (NASDAQ:SELB) drops 17% this week, taking five-year losses to 85%We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really... |

Selecta Biosciences Announces Merger with Cartesian Therapeutics– Merger creates a fully integrated, publicly traded company pioneering RNA cell therapy for the treatment of autoimmune disease – – Cartesian’s wholly owned pipeline includes a Phase 2 lead asset, Descartes-08, for which deep and durable responses have been observed in patients with myasthenia gravis (MG) – – Multiple near-term catalysts, including data from the Phase 2b study of Descartes-08 in MG expected in mid-2024 and initiation of multiple studies in additional autoimmune indications – – |

Selecta Announces Transition of Manufacturing and Clinical Operations of ImmTOR for SEL-212 to Commercialization Partner SobiWATERTOWN, Mass., Oct. 31, 2023 (GLOBE NEWSWIRE) -- Selecta Biosciences, Inc. (NASDAQ: SELB), a biotechnology company leveraging its clinically validated ImmTOR™ platform to develop tolerogenic therapies for autoimmune diseases and gene therapies, today announced that it has entered into an agreement to transition the manufacturing and development rights and remaining clinical operations of ImmTOR for SEL-212 to its development and commercialization partner, Swedish Orphan Biovitrum AB (publ.) ( |

The Petri Dish: Selecta gets selective with drug programs; Moderna enters 2nd cancer vaccine collabA Watertown biotech trimmed its pipeline again, setting aside all of its experimental drugs except one. It's the second time the company has cut programs this year. Plus other life sciences news you may have missed. |

Q2 2023 Selecta Biosciences Inc Earnings CallQ2 2023 Selecta Biosciences Inc Earnings Call |

SELB Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -16.19% |

| 3-year | -74.49% |

| 5-year | -48.24% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -65.34% |

| 2021 | 7.59% |

| 2020 | 27.31% |

| 2019 | -10.53% |

Loading social stream, please wait...