SEMrush Holdings, Inc. (SEMR): Price and Financial Metrics

SEMR Price/Volume Stats

| Current price | $15.06 | 52-week high | $16.42 |

| Prev. close | $14.15 | 52-week low | $7.36 |

| Day low | $14.24 | Volume | 596,749 |

| Day high | $15.07 | Avg. volume | 574,657 |

| 50-day MA | $14.40 | Dividend yield | N/A |

| 200-day MA | $12.23 | Market Cap | 2.19B |

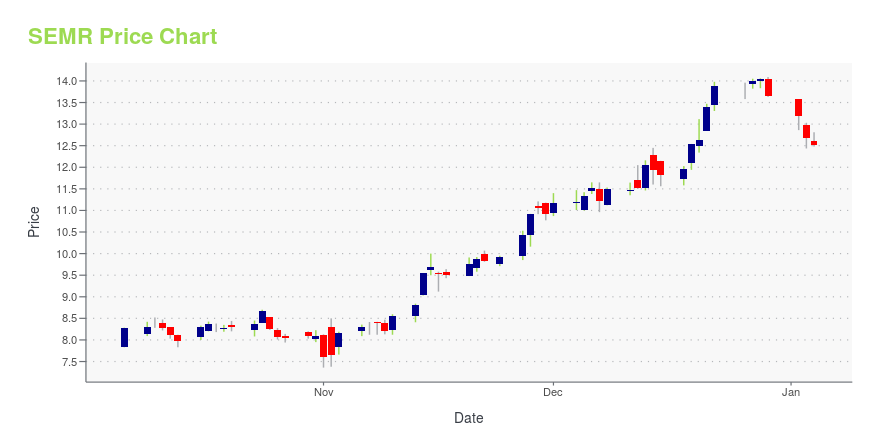

SEMR Stock Price Chart Interactive Chart >

SEMrush Holdings, Inc. (SEMR) Company Bio

SEMrush Holdings, Inc. develops online visibility management software as a service (SaaS) platform. It helps businesses to run search engine optimization, pay-per-click, content, social media, and competitive research campaigns. The company offers insights and solutions to build, manage, and measure campaigns across various marketing channels. SEMrush Holdings, Inc. was founded in 2008 and is based in Boston, Massachusetts with additional offices in Pennsylvania, Texas, Czech Republic, Cyprus, Poland, and Russia.

Latest SEMR News From Around the Web

Below are the latest news stories about SEMRUSH HOLDINGS INC that investors may wish to consider to help them evaluate SEMR as an investment opportunity.

UserWay and Semrush Supercharge Digital Marketing with Accessibility ToolsUserWay (TASE: UWAY), a full-service provider of digital accessibility technologies, announced a collaboration with Semrush (NYSE: SEMR) the leading online visibility management SaaS platform. UserWay's web accessibility compliance technology is now available on the Semrush App Center, including the UserWay Accessibility Scanner and the UserWay Accessibility Widget. |

Are You Looking for a Top Momentum Pick? Why SEMrush Holdings, Inc. (SEMR) is a Great ChoiceDoes SEMrush Holdings, Inc. (SEMR) have what it takes to be a top stock pick for momentum investors? Let's find out. |

Yext (YEXT) Reports Q3: Everything You Need To Know Ahead Of EarningsOnline reputation and search platform Yext (NYSE:YEXT) will be reporting earnings tomorrow after the bell. Here's what to look for. |

Insider Sell Alert: President Eugenie Levin Sells 39,076 Shares of SEMrush Holdings Inc (SEMR)In a notable insider transaction, President Eugenie Levin sold 39,076 shares of SEMrush Holdings Inc (NYSE:SEMR) on December 1, 2023. |

Why SEMrush Holdings, Inc. (SEMR) Might be Well Poised for a SurgeSEMrush Holdings, Inc. (SEMR) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. |

SEMR Price Returns

| 1-mo | 16.02% |

| 3-mo | 25.29% |

| 6-mo | 27.95% |

| 1-year | 48.81% |

| 3-year | -23.90% |

| 5-year | N/A |

| YTD | 10.25% |

| 2023 | 67.81% |

| 2022 | -60.96% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...