Sprouts Farmers Market, Inc. (SFM): Price and Financial Metrics

SFM Price/Volume Stats

| Current price | $86.70 | 52-week high | $86.73 |

| Prev. close | $83.21 | 52-week low | $36.21 |

| Day low | $84.41 | Volume | 1,307,188 |

| Day high | $86.73 | Avg. volume | 1,310,913 |

| 50-day MA | $80.35 | Dividend yield | N/A |

| 200-day MA | $60.35 | Market Cap | 8.71B |

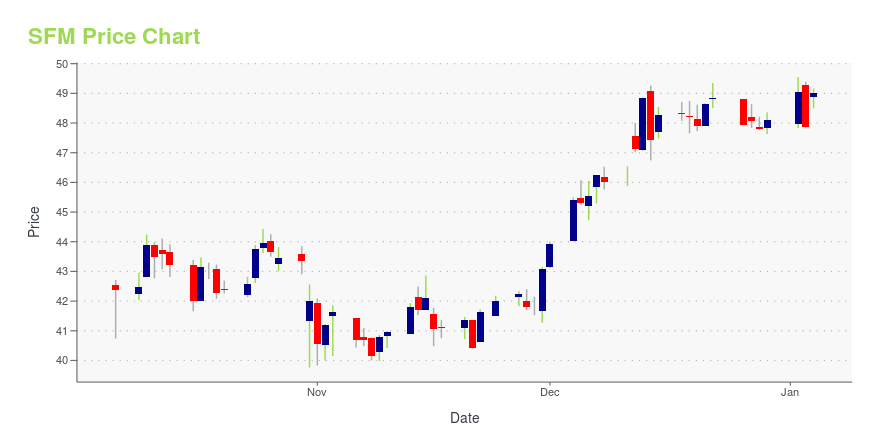

SFM Stock Price Chart Interactive Chart >

Sprouts Farmers Market, Inc. (SFM) Company Bio

Sprouts Farmers Market operates as a specialty retailer of fresh, natural, and organic food in the United States. The company was founded in 2002 and is based in Phoenix, Arizona.

Latest SFM News From Around the Web

Below are the latest news stories about SPROUTS FARMERS MARKET INC that investors may wish to consider to help them evaluate SFM as an investment opportunity.

3 Stocks With Incredible Growth Potential to Buy for 2024These stocks should serve investors well over the long run. |

Here's Why Sprouts Farmers (SFM) is Staying Ahead of IndustrySprouts Farmers (SFM) is benefiting from strategic initiatives, including omni-channel solutions, expanding customer base and focus on private-label products. |

Does This Valuation Of Sprouts Farmers Market, Inc. (NASDAQ:SFM) Imply Investors Are Overpaying?Key Insights Using the 2 Stage Free Cash Flow to Equity, Sprouts Farmers Market fair value estimate is US$38.84 Sprouts... |

3 Short-Squeeze Stocks Ready for a Year-End RallyThese are a few companies that have seen considerable gains this year that still have a large percentage of short interest. |

Sprouts Broadens On-Demand Delivery by Partnering with UberPHOENIX, December 11, 2023--Sprouts Farmers Market, is now available on Uber Eats for on-demand grocery delivery. Customers can order fresh, natural and organic items on the app. |

SFM Price Returns

| 1-mo | 4.37% |

| 3-mo | 29.44% |

| 6-mo | 74.27% |

| 1-year | 121.00% |

| 3-year | 251.15% |

| 5-year | 395.71% |

| YTD | 80.21% |

| 2023 | 48.63% |

| 2022 | 9.06% |

| 2021 | 47.66% |

| 2020 | 3.88% |

| 2019 | -17.69% |

Continue Researching SFM

Want to see what other sources are saying about Sprouts Farmers Market Inc's financials and stock price? Try the links below:Sprouts Farmers Market Inc (SFM) Stock Price | Nasdaq

Sprouts Farmers Market Inc (SFM) Stock Quote, History and News - Yahoo Finance

Sprouts Farmers Market Inc (SFM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...