Shift Technologies, Inc. (SFT): Price and Financial Metrics

SFT Price/Volume Stats

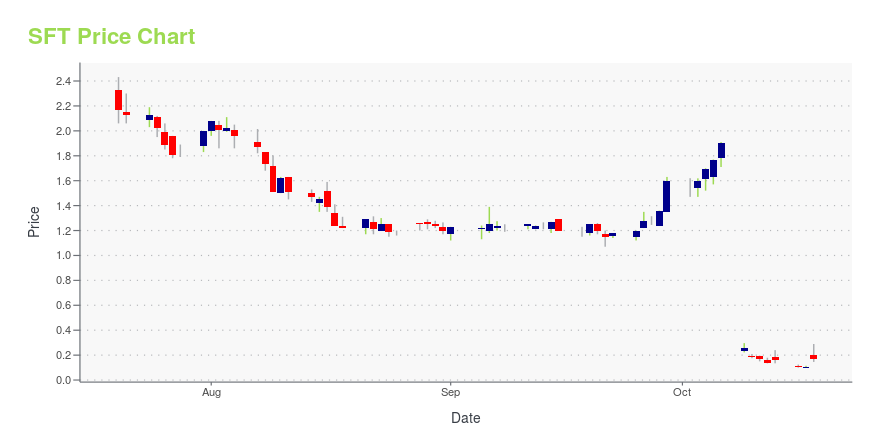

| Current price | $0.17 | 52-week high | $5.90 |

| Prev. close | $0.11 | 52-week low | $0.10 |

| Day low | $0.15 | Volume | 178,345,400 |

| Day high | $0.29 | Avg. volume | 1,807,517 |

| 50-day MA | $1.15 | Dividend yield | N/A |

| 200-day MA | $1.70 | Market Cap | 2.90M |

SFT Stock Price Chart Interactive Chart >

Shift Technologies, Inc. (SFT) Company Bio

Shift Technologies, Inc. operates as a car dealer. The Company offers new and used cars, as well as provides rental, maintenance, post warranty repairs, mechanical and painting work, diagnosis insurance, and security services. Shift Technologies serves individuals, commercial, and fleet clients in the United States.

Latest SFT News From Around the Web

Below are the latest news stories about SHIFT TECHNOLOGIES INC that investors may wish to consider to help them evaluate SFT as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic worth checking out on Wednesday and we have all the latest news happening this morning! |

Why Is Nuvve (NVVE) Stock Down 37% Today?Nuvve stock is sliding lower on Wednesday as investors in NVVE shares react to plans for a public offering from the green energy company. |

Why Is Nuzee (NUZE) Stock Down 36% Today?Nuzee stock is falling on Friday as investors in NUZE shares react to a proposed public stock offering from the coffee company! |

Why Is RVL Pharmaceuticals (RVLP) Stock Up 40% Today?RVL Pharmaceuticals stock is rising higher on Wednesday with heavy trading of RVLP shares even without any news from the company. |

Why Is Shift Technologies (SFT) Stock Up 111% Today?Shift Technologies stock is taking off on Wednesday with heavy trading of SFT shares despite a lack of news from the company. |

SFT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -90.61% |

| 3-year | -99.80% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -95.63% |

| 2021 | -58.77% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...