Sweetgreen Inc. (SG): Price and Financial Metrics

SG Price/Volume Stats

| Current price | $25.66 | 52-week high | $36.72 |

| Prev. close | $24.40 | 52-week low | $8.64 |

| Day low | $25.36 | Volume | 3,167,339 |

| Day high | $26.92 | Avg. volume | 2,565,715 |

| 50-day MA | $29.22 | Dividend yield | N/A |

| 200-day MA | $18.50 | Market Cap | 2.91B |

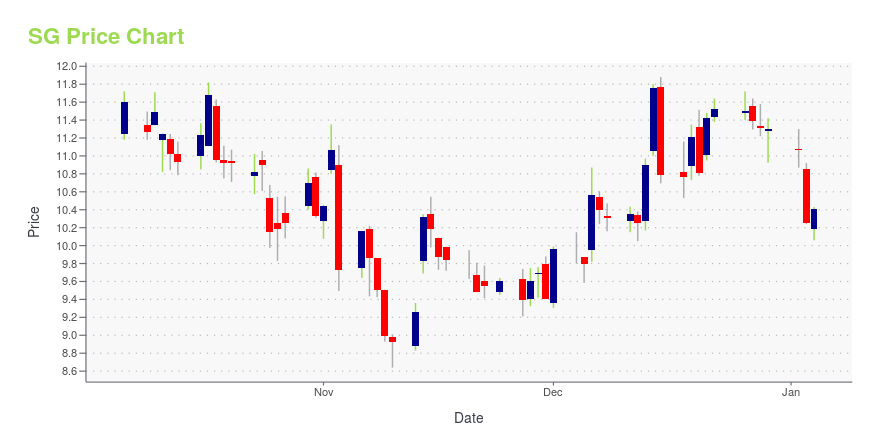

SG Stock Price Chart Interactive Chart >

Sweetgreen Inc. (SG) Company Bio

Sweetgreen is an American fast-casual restaurant chain that serves simple, seasonal, healthy salads, and grain bowls made in-house from scratch, using whole produce delivered that morning. Founded in 2007, the company is based in Washington, District of Columbia.

Latest SG News From Around the Web

Below are the latest news stories about SWEETGREEN INC that investors may wish to consider to help them evaluate SG as an investment opportunity.

Sweetgreen Stock Generating Improved Relative Strength RatingSweetgreen shows improving price performance, earning an upgrade to its IBD Relative Strength Rating |

Drone delivery startup Zipline to expand package drop-off across the USThanks to shifting regulations, autonomous drone delivery startup Zipline aims to expand its service to a handful of cities in 2024. |

Drone delivery to reach new heights and speedsIn this episode of Yahoo Finance series NEXT, Yahoo Finance reporter Akiko Fujita visits San Francisco startup Zipline to get a first-hand look at how delivery services are being automated with drones. The vision of drone delivery has been around for years, with Amazon (AMZN) being one of the first to launch its drone delivery program “Prime Air” in 2013. What has kept the industry from scaling up to widespread use? Regulation. In the race to deliver at new heights, the FAA has granted Zipline a rare exception to fly drones beyond the visual line of sight. With commercial drone deliveries projected to exceed 1 million by the end of 2023, Zipline plans to lead the way introducing drone technology to as many as 15 cities in the US across healthcare, restaurants, and retail by 2025. Ziplin... |

Sweetgreen chief development officer will step downJim McPhail will leave the company on Dec. 31 after working as CDO for four years, and Timothy Noonan has been promoted to SVP of development and will assume McPhail’s development responsibilities. |

How one drive-thru chain aims to revolutionize saladsDrive-thru salad restaurant Salad and Go is set to expand in 2024 and beyond, and CEO Charlie Morrison believes the “double drive-thru” model will revolutionize affordability and accessibility for healthy foods. According to Morrison, the salad business is a “pretty fragmented market” with space to grow and expand. Salad and Go offers a 48 oz. salad meal with one protein for $7, which appears to be an increasingly cost-effective value deal compared to competitor offerings from CAVA (CAVA) and Sweetgreen (SG). Morrison states the company’s priority is to redeploy “specialized labor." With fewer laborers in the central kitchen and more staff working within the supply chain, Morrison believes this will allow for higher wages of over $20 per hour. For more expert insight and the latest mark... |

SG Price Returns

| 1-mo | -10.03% |

| 3-mo | 4.65% |

| 6-mo | 144.61% |

| 1-year | 66.08% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 127.08% |

| 2023 | 31.86% |

| 2022 | -73.22% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching SG

Here are a few links from around the web to help you further your research on Sirius International Insurance Group Ltd's stock as an investment opportunity:Sirius International Insurance Group Ltd (SG) Stock Price | Nasdaq

Sirius International Insurance Group Ltd (SG) Stock Quote, History and News - Yahoo Finance

Sirius International Insurance Group Ltd (SG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...