SG Blocks, Inc. (SGBX): Price and Financial Metrics

SGBX Price/Volume Stats

| Current price | $2.40 | 52-week high | $43.60 |

| Prev. close | $2.28 | 52-week low | $2.01 |

| Day low | $2.21 | Volume | 200,281 |

| Day high | $2.54 | Avg. volume | 945,116 |

| 50-day MA | $3.11 | Dividend yield | N/A |

| 200-day MA | $6.25 | Market Cap | 3.23M |

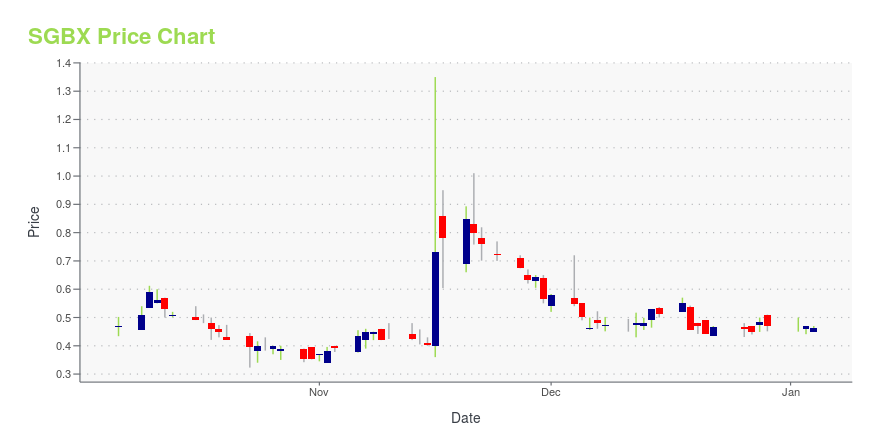

SGBX Stock Price Chart Interactive Chart >

SG Blocks, Inc. (SGBX) Company Bio

SG Blocks, Inc. provides code engineered cargo shipping containers primarily in the United States. The company redesigns, repurposes, and converts heavy-gauge steel cargo shipping containers into green building blocks for commercial, industrial, and residential building construction. It also provides engineering and project management services related to the use of modified containers in construction. The company serves architects, builders, and owners. SG Blocks, Inc. was founded in 2007 and is headquartered in Brooklyn, New York.

Latest SGBX News From Around the Web

Below are the latest news stories about SAFE & GREEN HOLDINGS CORP that investors may wish to consider to help them evaluate SGBX as an investment opportunity.

This Safe & Green Holdings Insider Increased Their Holding In The Last YearFrom what we can see, insiders were net buyers in Safe & Green Holdings Corp.'s ( NASDAQ:SGBX ) during the past 12... |

Safe & Green Holdings Secures $600,000 Advance Against the IRS Employee Retention Tax Credit RefundMIAMI, December 26, 2023--Safe & Green Holdings Corp. (NASDAQ: SGBX) ("Safe & Green Holdings" or the "Company"), a leading developer, designer, and fabricator of modular structures for residential, commercial, and point-of-care medicine, today announced the Company has secured a $600,000 advance against the recently announced $1.5 million refund from the IRS for the Employee Retention Tax Credit (ERTC), which is a refundable credit. The timing of the receipt of the refund is unknown and is relia |

Safe & Green Holdings Corp. Announces That David Cross, VP of Sales and Business Development, Has Been Selected to Serve on the Modular Building Institute’s Government Affairs CommitteeMIAMI, December 22, 2023--Safe & Green Holdings Corp. (NASDAQ: SGBX) ("Safe & Green Holdings" or the "Company"), a leading developer, designer, and fabricator of modular structures for residential, commercial, and point-of-care medicine, today announced that David Cross, Co-Founder and Vice President of Sales and Business Development for Safe and Green Holdings, has been selected to serve on the Modular Building Institute’s Government Affairs Committee. |

Safe & Green Holdings Announces Collaboration with Earth Our Common Home (ECHo) to Launch the ECHo Impact Investment Fund for AfricaMIAMI, December 20, 2023--Safe & Green Holdings Corp. (NASDAQ: SGBX) ("Safe & Green Holdings" or the "Company"), a leading developer, designer, and fabricator of modular structures for residential, commercial, and point-of-care medicine, today announced that the Company has commenced discussions with Earth our Common Home, Inc. ("ECHo"), a Delaware 501(c)(3) corporation, to create the ECHo Impact Investment Fund for Africa ("The Fund"), which will enable potential impact investments in furtheran |

Safe & Green Holdings Corp. Announces Master Purchase Agreement With Safe and Green Development Corporation for Manufacturing Projects Initially Valued in Excess of $140 MillionMIAMI, December 18, 2023--Safe & Green Holdings Corp. (NASDAQ: SGBX) ("Safe & Green Holdings" or the "Company"), a leading developer, designer, and fabricator of modular structures for residential, commercial, and point-of-care medicine, today announced its SG Echo subsidiary has executed a Master Purchase Agreement (MPA) with Safe and Green Development Corporation (NASDAQ: SGD) ("SG DevCo"), the Company’s real estate development subsidiary, which recently completed a spinout as a standalone pub |

SGBX Price Returns

| 1-mo | -21.31% |

| 3-mo | -18.53% |

| 6-mo | -70.03% |

| 1-year | -89.33% |

| 3-year | -97.14% |

| 5-year | -99.32% |

| YTD | -74.51% |

| 2023 | -65.64% |

| 2022 | -27.13% |

| 2021 | -69.18% |

| 2020 | 94.39% |

| 2019 | -94.20% |

Continue Researching SGBX

Want to do more research on Sg Blocks Inc's stock and its price? Try the links below:Sg Blocks Inc (SGBX) Stock Price | Nasdaq

Sg Blocks Inc (SGBX) Stock Quote, History and News - Yahoo Finance

Sg Blocks Inc (SGBX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...