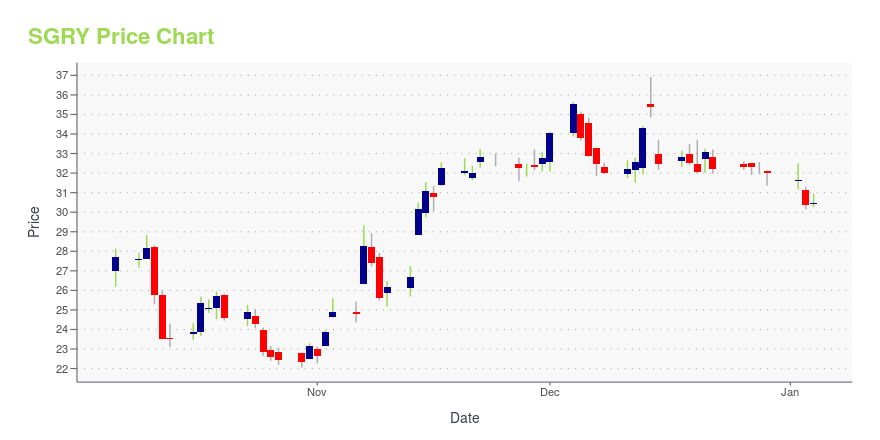

Surgery Partners, Inc. (SGRY): Price and Financial Metrics

SGRY Price/Volume Stats

| Current price | $32.02 | 52-week high | $39.64 |

| Prev. close | $30.75 | 52-week low | $22.05 |

| Day low | $30.88 | Volume | 1,396,868 |

| Day high | $32.21 | Avg. volume | 982,813 |

| 50-day MA | $25.89 | Dividend yield | N/A |

| 200-day MA | $28.47 | Market Cap | 4.07B |

SGRY Stock Price Chart Interactive Chart >

Surgery Partners, Inc. (SGRY) Company Bio

Surgery Partners Inc. is a healthcare services company focused on providing high-quality, cost-effective solutions for surgical and related ancillary care in support of the company's patients and physicians. The company was founded in 2004 and is based in Nashville, Tennessee.

Latest SGRY News From Around the Web

Below are the latest news stories about SURGERY PARTNERS INC that investors may wish to consider to help them evaluate SGRY as an investment opportunity.

Insider Sell: Exec Chairman Wayne Deveydt Sells 168,130 Shares of Surgery Partners Inc (SGRY)Wayne Deveydt, the Executive Chairman of the Board of Surgery Partners Inc (NASDAQ:SGRY), has executed a significant stock sale according to a recent SEC filing. |

Surgery Partners, Inc. Announces Proposed Secondary Offering of Common StockBRENTWOOD, Tenn., Dec. 14, 2023 (GLOBE NEWSWIRE) -- Surgery Partners, Inc. (Nasdaq: SGRY) (“Surgery Partners” or the “Company”) today announced that certain of the Company’s stockholders (the “Selling Stockholders”) intend to offer for sale in an underwritten secondary offering (the “Offering”) 8,000,000 shares of the Company’s common stock, par value $0.01 per share. The offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be c |

Here’s Why Surgery Partners (SGRY) Declined in Q3ClearBridge Investments, an investment management company, released its “ClearBridge Select Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. Rising bond rates and the Federal Reserve’s shift to a more hawkish stance put pressure on stocks in the third quarter. The strategy underperformed its Russell 3000 Index in the third […] |

Does Insulet (PODD) Face Challenges from the New Weight Loss Drug?ClearBridge Investments, an investment management company, released its “ClearBridge Select Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. Rising bond rates and the Federal Reserve’s shift to a more hawkish stance put pressure on stocks in the third quarter. The strategy underperformed its Russell 3000 Index in the third […] |

Surgery Partners, Inc. Completes Refinancing TransactionBRENTWOOD, Tenn., Dec. 06, 2023 (GLOBE NEWSWIRE) -- Surgery Partners, Inc. (NASDAQ:SGRY) (“Surgery Partners” or the “Company”), a leading short-stay surgical facility owner and operator, announced today that Surgery Center Holdings, Inc., a wholly owned subsidiary of the Company, has received commitments for a new $1.4 billion senior secured term loan (the “New Term Loan”). Upon closing (such date, the “Closing Date”), the new Term Loan will bear interest at a rate equal to 3.50% per annum in ex |

SGRY Price Returns

| 1-mo | 35.97% |

| 3-mo | 30.43% |

| 6-mo | 1.11% |

| 1-year | -14.59% |

| 3-year | -42.21% |

| 5-year | 321.87% |

| YTD | 0.09% |

| 2023 | 14.82% |

| 2022 | -47.84% |

| 2021 | 84.11% |

| 2020 | 85.31% |

| 2019 | 59.91% |

Continue Researching SGRY

Want to see what other sources are saying about Surgery Partners Inc's financials and stock price? Try the links below:Surgery Partners Inc (SGRY) Stock Price | Nasdaq

Surgery Partners Inc (SGRY) Stock Quote, History and News - Yahoo Finance

Surgery Partners Inc (SGRY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...